Lightweighting Demand

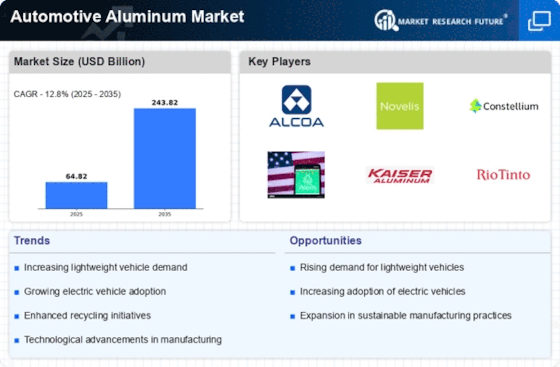

The Automotive Aluminum Market experiences a pronounced demand for lightweight materials, driven by the need for improved fuel efficiency and reduced emissions. Automakers are increasingly adopting aluminum to meet stringent regulatory standards regarding fuel economy. In fact, vehicles that utilize aluminum components can achieve weight reductions of up to 50% compared to traditional steel. This shift not only enhances performance but also contributes to lower operational costs for consumers. As a result, the market for automotive aluminum is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This trend underscores the critical role of lightweighting in the automotive sector, positioning aluminum as a preferred material for manufacturers aiming to enhance vehicle efficiency.

Enhanced Safety Standards

The Automotive Aluminum Market is also influenced by the increasing emphasis on safety standards in vehicle manufacturing. Aluminum's inherent properties, such as high strength-to-weight ratio and energy absorption capabilities, make it an ideal choice for enhancing vehicle safety. Manufacturers are integrating aluminum into critical structural components to meet or exceed safety regulations. For instance, the use of aluminum in crumple zones can significantly improve crash performance, thereby protecting occupants. As safety regulations become more stringent, the demand for aluminum in automotive applications is expected to rise. This trend is likely to contribute to a steady growth trajectory for the automotive aluminum market, with estimates suggesting a potential increase in market share as manufacturers prioritize safety alongside performance.

Recycling and Sustainability

Sustainability initiatives are becoming increasingly vital within the Automotive Aluminum Market, particularly regarding recycling practices. Aluminum is highly recyclable, with the ability to retain its properties after multiple cycles of recycling. This characteristic aligns with the automotive industry's shift towards sustainable practices, as manufacturers seek to reduce their carbon footprint. The recycling of aluminum requires only 5% of the energy needed to produce new aluminum, making it an environmentally friendly option. As automakers commit to sustainability goals, the demand for recycled aluminum is expected to rise. This trend not only supports environmental objectives but also enhances the economic viability of aluminum as a material choice. Consequently, the automotive aluminum market is poised for growth, driven by the increasing integration of recycled materials in vehicle production.

Growing Electric Vehicle Production

The rise in electric vehicle (EV) production is a pivotal driver for the Automotive Aluminum Market. As manufacturers pivot towards electrification, aluminum's lightweight properties become increasingly advantageous. EVs require efficient energy use to maximize range, and aluminum helps achieve this by reducing overall vehicle weight. Reports indicate that the use of aluminum in EVs can lead to a weight reduction of approximately 30% compared to conventional vehicles. This trend is further supported by government incentives and consumer demand for sustainable transportation solutions. Consequently, the automotive aluminum market is likely to witness robust growth, with projections indicating that aluminum content in EVs could reach 300 kilograms by 2030, reflecting the material's integral role in the future of automotive design.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are significantly impacting the Automotive Aluminum Market. Innovations such as advanced casting techniques and improved welding methods are enhancing the efficiency and effectiveness of aluminum production. These technologies allow for the creation of complex shapes and structures that were previously challenging to achieve. Moreover, the introduction of automation and robotics in manufacturing processes is streamlining production, reducing costs, and improving quality. As manufacturers adopt these technologies, the overall competitiveness of aluminum in the automotive sector is likely to improve. This trend suggests a positive outlook for the automotive aluminum market, with potential increases in production capacity and a broader range of applications for aluminum components in future vehicle designs.