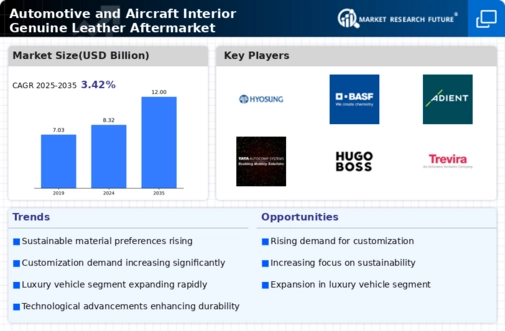

The Automotive and Aircraft Interior Genuine Leather Aftermarket is an industry characterized by a blend of innovation, craftsmanship, and competitive rivalry. As consumer preferences shift towards high-quality and sustainable materials, the demand for genuine leather in automotive and aircraft interiors is being propelled to new heights.

This market not only requires an understanding of evolving consumer demands but also necessitates a thorough analysis of competitors who are striving to capture market share through various strategies, such as product diversification, technological advancements, and sustainability initiatives.

Key players in this space are engaging in partnerships, leveraging supply chain efficiencies, and optimizing production processes to ensure premium quality and enhanced functionality of their products. The competitive landscape is marked by the integration of traditional craftsmanship with modern manufacturing techniques, creating opportunities for differentiation and market expansion.

Hyosung has carved out a significant presence in the Automotive and Aircraft Interior Genuine Leather Aftermarket, showcasing notable strengths that contribute to its competitive edge. The company is recognized for its advanced yarn technologies, which facilitate the production of high-quality synthetic leather that closely resembles genuine leather, appealing to environmentally conscious consumers.

With a strong focus on innovation, Hyosung emphasizes research and development to enhance product durability and aesthetic appeal, positioning itself as a key player in meeting the demands of both the automotive and aircraft sectors.

Its commitment to sustainability and eco-friendly practices resonates with market trends, allowing Hyosung to effectively cater to OEMs and Aftermarket clients looking for responsible sourcing options. Furthermore, the company's efficient supply chain management enhances its ability to respond quickly to market changes and customer needs, solidifying its footprint in the Aftermarket landscape.

BASF stands out in the Automotive and Aircraft Interior Genuine Leather Aftermarket by leveraging its extensive expertise in chemical solutions and sustainable practices. The company is recognized for its innovative polyurethane-based materials that are specifically designed to meet the rigorous standards of automotive and aircraft interiors.

BASF's continuous investment in research and development allows it to deliver superior materials that not only enhance the visual and tactile qualities of interior designs but also offer superior performance characteristics such as resistance to wear and fading.

Its strong presence and established relationships with major automotive and aircraft manufacturers further strengthen its position in the Aftermarket.

By focusing on sustainability, BASF is committed to delivering products that adhere to environmental regulations while meeting the growing demand for high-quality leather alternatives. This combination of innovative solutions and sustainability initiatives enables BASF to remain a formidable competitor in the Automotive and Aircraft Interior Genuine Leather Aftermarket.

Leave a Comment