Research Methodology on Commercial Aircraft Cabin Interior Market

1. Introduction:

The objective of this research is to investigate the overall market size of the Commercial Aircraft Cabin Interior (CACI) market and to provide an in-depth analysis of the CACI product segmentation. Market Research Future (MRFR) has conducted a comprehensive study of the CACI market and published a comprehensive report titled Commercial Aircraft Cabin Interior Market Research Report Forecast to 2030. This report enables readers to gain valuable insights into the market size, major trends, drivers, restraints, opportunities, and challenges of the CACI market. The report also includes a detailed qualitative and quantitative analysis of the CACI market and provides a relative comparison between the various segments.

2. Research Objective:

The primary objective of this research is to identify the current landscape of the Commercial Aircraft Cabin Interior market and to gain valuable insights into the market size, major trends, drivers, restraints, opportunities, and challenges of the CACI market. This research shall also involve a detailed analysis of the CACI product segmentation and provide a relative comparison between the various segments.

3. Research Design:

MRFR has adopted a descriptive research design for this study as it is well suited for analyzing quantitative data. Descriptive analysis of the market involves the identification of the drivers and restraints which are influencing the market at present.

4. Research Scope:

The research scope encompasses the following aspects:

- Identification of the drivers and restraints of the CACI market

- Analysis of the CACI product segmentation

- Estimation of the market size and growth rate of the CACI market

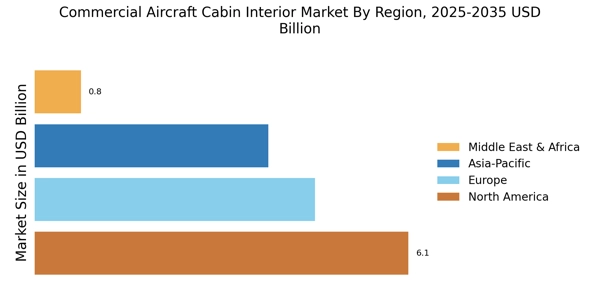

- Regional analysis of the CACI market

- Comprehensive qualitative and quantitative analysis of the CACI market

5. Research Sources:

In order to gain valuable insights into the market size, major trends, drivers, restraints, opportunities, and challenges of the CACI market, primary and secondary sources were used for this research. Secondary research sources include articles, reports, company websites, and industry whitepapers. Primary sources include interviews with industry experts and subject matter experts.

6. Data Collection and Analysis:

Data collection is done using both primary and secondary sources. Initial data collection includes an analysis of the top industry players and the relevant market dynamics. Further data collection was done through interviews with experts in the CACI industry. Interviewees include the CEOs and the senior personnel of the top companies in the industry. The interviews were used to validate the collected data and to gain in-depth knowledge about the CACI market. The data was analyzed using primary and secondary research methods such as SWOT analysis, Porter’s Five forces analysis, and investor sentiment analysis.