Stringent Emission Regulations

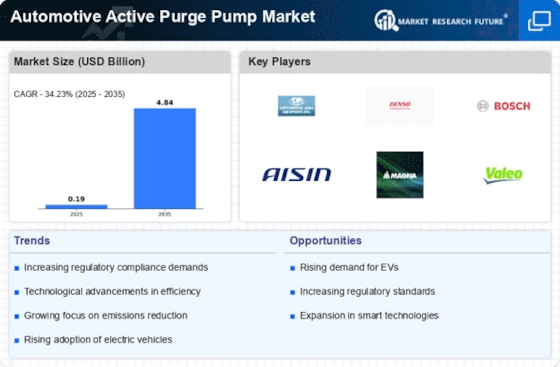

The Automotive Active Purge Pump Market is significantly influenced by stringent emission regulations imposed by various governments. These regulations aim to reduce harmful emissions from vehicles, pushing manufacturers to adopt advanced technologies that comply with environmental standards. Active purge pumps are essential in controlling evaporative emissions, thus helping automakers meet these regulatory requirements. As a result, the market for active purge pumps is projected to expand, with estimates suggesting a compound annual growth rate of around 5% over the next few years. This regulatory landscape is likely to foster innovation and investment in the Automotive Active Purge Pump Market.

Rising Demand for Fuel Efficiency

The Automotive Active Purge Pump Market is experiencing a notable increase in demand for fuel-efficient vehicles. As consumers become more environmentally conscious, automakers are compelled to enhance fuel economy in their offerings. The integration of active purge pumps plays a crucial role in optimizing fuel vapor management, thereby improving overall vehicle efficiency. According to recent data, vehicles equipped with advanced purge systems can achieve up to 10% better fuel economy compared to traditional systems. This trend is likely to drive the growth of the Automotive Active Purge Pump Market, as manufacturers seek to meet consumer expectations and regulatory standards for emissions.

Increased Production of Electric Vehicles

The Automotive Active Purge Pump Market is also impacted by the rising production of electric vehicles (EVs). While EVs do not rely on traditional combustion engines, the need for effective vapor management systems remains relevant, particularly in hybrid models. As automakers expand their EV offerings, the demand for active purge pumps may evolve to accommodate new technologies and systems. This shift could lead to a diversification of products within the Automotive Active Purge Pump Market, as manufacturers seek to innovate and adapt to changing consumer preferences and regulatory requirements. The growth of the EV segment may thus create new opportunities for active purge pump manufacturers.

Technological Innovations in Automotive Design

The Automotive Active Purge Pump Market is benefiting from ongoing technological innovations in automotive design. The development of more sophisticated purge pump systems, including electronic and variable displacement pumps, enhances the efficiency and reliability of vapor management systems. These innovations not only improve vehicle performance but also contribute to lower emissions. As manufacturers increasingly adopt these advanced technologies, the market for active purge pumps is expected to grow. Recent projections indicate that the market could reach a valuation of several hundred million dollars by the end of the decade, reflecting the importance of technological advancements in shaping the Automotive Active Purge Pump Market.

Consumer Preference for Advanced Vehicle Features

The Automotive Active Purge Pump Market is influenced by consumer preferences for advanced vehicle features. As buyers increasingly seek vehicles equipped with the latest technologies, automakers are compelled to integrate systems that enhance performance and efficiency. Active purge pumps are integral to modern vehicles, contributing to improved fuel economy and reduced emissions. Market Research Future indicates that consumers are willing to pay a premium for vehicles that offer superior environmental performance, which in turn drives demand for advanced purge systems. This trend suggests a robust growth trajectory for the Automotive Active Purge Pump Market, as manufacturers respond to evolving consumer expectations.