Top Industry Leaders in the Automotive Active Purge Pump Market

*Disclaimer: List of key companies in no particular order

*Disclaimer: List of key companies in no particular order

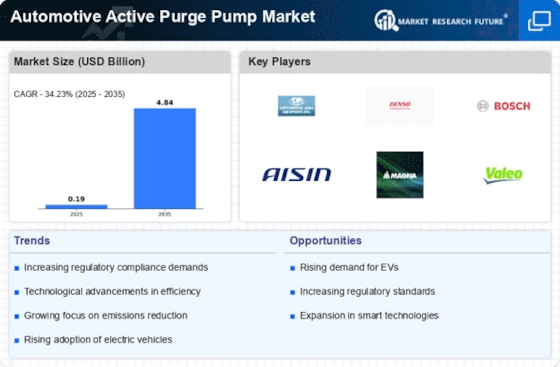

Top listed companies in the Automotive Active Purge Pump industry are:

Continental AG (Germany)

Agilent Technologies (U.S.)

Robert Bosch GmbH (Germany)

Denso Corporation (Japan)

Established Titans and Their Playbook:

Tier 1 Suppliers: Bosch, Continental, Denso, and Magna International hold a dominant position, leveraging their strong relationships with automakers and established distribution networks. These giants focus on continuous innovation, expanding product portfolios with high-efficiency, lightweight pumps, and pursuing strategic partnerships for regional expansion. Bosch's collaboration with Valeo exemplifies this, aiming to capture market share in Europe.

Material Specialists: Companies like Lydall and Donaldson Filtration excel in specific materials like non-woven fabrics for pump diaphragms. Their competitive edge lies in proprietary technologies and stringent quality control, catering to niche applications within the market. Lydall's focus on bio-based materials aligns with the industry's green push, giving them an edge in environmentally conscious markets.

Emerging Disruptors: Agility and Innovation Fueling Growth:

Start-ups and SMEs: Nimble start-ups like Pierburg Pumps Korea and Hanon Systems are carving a niche with cost-effective pumps and customized solutions. Their agility allows them to respond quickly to changing market demands and cater to specific regional needs. Pierburg's focus on low-noise pumps catering to the electric vehicle segment is a prime example.

Technology Players: Tech giants like Siemens and Eaton are leveraging their expertise in electronics and automation to develop intelligent purge pump systems. These systems offer real-time data monitoring and adaptive control, appealing to automakers seeking enhanced efficiency and emission reduction. Siemens' recent acquisition of Dresser-Rand further bolsters their position in this space.

Market Share Analysis: A Multifaceted Game:

Regional Variations: Europe currently leads the pack, driven by stringent emission regulations and a burgeoning luxury car market. However, Asia-Pacific is expected to witness the fastest growth due to a rapidly expanding automotive sector and government initiatives promoting clean mobility. This necessitates players to tailor their strategies to regional specificities.

Technology and Material Advancements: Continuous advancements in pump design, materials like carbon fiber, and integration of sensors are reshaping the competitive landscape. Players who invest in R&D and stay ahead of the curve will gain a significant edge.

Vertical Integration and Partnerships: Establishing strong vertical integration and strategic partnerships across the supply chain is crucial for cost optimization and securing vital resources. For instance, Continental's collaboration with plastic manufacturer Evonik for diaphragm materials gives them greater control over production and quality.

New and Emerging Trends: Charting the Future Course:

Electrification Wave: The rise of electric vehicles presents both challenges and opportunities. While demand for traditional purge pumps might decline, new applications like battery thermal management systems are emerging. Players who adapt their technology and product offerings to cater to EVs will thrive.

Sustainability Imperative: The focus on reducing carbon footprint is pushing for energy-efficient pumps and the use of recycled materials. Companies like Donaldson Filtration, with their expertise in sustainable filtration solutions, are well-positioned to capitalize on this trend.

Data-Driven Insights: The integration of sensors and AI in purge pump systems is enabling real-time performance monitoring and predictive maintenance. This opens doors for data-driven services and aftermarket revenue streams, with players like Siemens poised to benefit from their existing expertise in these areas.

Overall Competitive Scenario: A Dynamic Tapestry:

The automotive active purge pump market is a dynamic tapestry woven with established players, agile disruptors, and evolving trends. Understanding the strategies, market share dynamics, and emerging trends is crucial for navigating this competitive landscape. Continuous innovation, regional adaptability, and embracing new technologies will be the key differentiators for success in this rapidly evolving market.

Latest Company Updates:

Continental AG (Germany):

- December 2023: Announced a partnership with a major Korean automaker to supply active purge pumps for its new hybrid vehicle lineup.

- October 2023: Unveiled a new generation of active purge pumps with improved efficiency and noise reduction capabilities. (Source: Continental Press Release)

Robert Bosch GmbH (Germany):

- September 2023: Received a major contract from a German luxury car manufacturer to supply active purge pumps for its upcoming electric vehicle platform.

Agilent Technologies (U.S.):

- August 2023: Launched a new line of test and measurement instruments specifically designed for characterizing the performance of active purge pumps. (Source: Agilent Technologies Website)

Denso Corporation (Japan):

- November 2023: Showcased its latest active purge pump technology at the Tokyo Motor Show, highlighting its compact size and high efficiency.