Market Share

Automated Suturing Devices Market Share Analysis

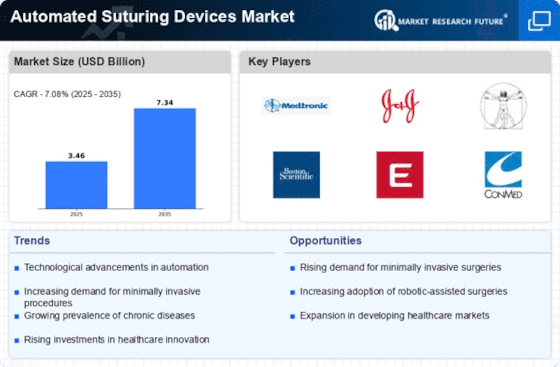

The Automated Suturing Devices market is undergoing significant growth, driven by advancements in surgical technology and the increasing demand for efficient and precise suturing methods. Market players are strategically implementing various positioning strategies to capitalize on this trend and establish a competitive advantage in the evolving landscape of surgical devices. Within the Automated Suturing Devices market the firms aim at diversifying their product lines by developing different types of automated suturing devices. This involves robotic-assisted suturing systems as well as handheld automated suturing devices and laparoscopic suturing devices. Both the various devices in use facilitate the product development stage to provide companies with the opportunity to serve unmet surgical procedure and environment needs hence positioning themselves as all inclusive solution providers. With regard to primary market positioning strategy, constant investment in research and development to move the process of automated suturing forward is the one adopted. Therefore, corporates continuously try to increase the accuracy, lower the operational times, and make the gadgets friendlier. Technological development guarantees their competitive edge and strengthens their image as the latest surgical devices. Comprehending the worldwide need of innovative surgical technologies, firms develop measures to make their international market penetration. Such types of activities must includes the marketing design which involves the creation of partnerships, collaborations and distribution networks to ensure appropriate market penetration and accessibility to automated suturing devices for various regions. Such agreements are crucial for the market’s success because production requires surgeons and surgical team and healthcare facilities. This is achieved by working with leading members in the medical field to glean from their knowledge on clinical needs, product development, and credibility within the surgical community to tackle a market share. In market positioning, the user-friendly interfaces and training programs are key elements to be given priority. It also tries to build suturing devices that will work automatically they are simple to operate, and demand little training as well as have user friendly controls. This has a positive impact adoption is increased and brand loyalty is built among surgical professionals. Following strict regulatory policies and safe automated suturing devices form the basic methods for market positioning. Companies spend on the certification, the deep and regular solving of safety issues, the constant upgrading of the device to the level that would keep the trust of healthcare providers and users. There would be a big positioning of products from automated suturing devices in real-time monitoring of the devices. The companies create devices that serve the surgeon s feedback on several factors in suturing, including suture tension, tissue response, and other key parameters; therefore, the suturing process as a whole may be made as precise and time-saving as possible. Leveraging data analytics is integral for informed decision-making. Companies analyze user data, market trends, and competitive landscapes to refine marketing strategies and adapt product development. Data-driven insights enable companies to stay responsive to the evolving needs of the Automated Suturing Devices market.

Leave a Comment