Focus on Labor Cost Reduction

In the context of the Automated Sortation System Market, the focus on reducing labor costs is becoming increasingly pronounced. Companies are seeking ways to minimize expenses while maintaining high levels of productivity. Automated sortation systems offer a viable solution by reducing the reliance on manual labor for sorting tasks. Data indicates that labor costs can account for up to 60% of total operational expenses in logistics. By implementing automated solutions, businesses can achieve significant cost savings and reallocate human resources to more strategic roles. This shift not only enhances operational efficiency but also positions companies to remain competitive in a challenging market landscape. As the pressure to optimize costs intensifies, the demand for automated sortation systems is expected to rise.

Growth of E-commerce and Retail Sectors

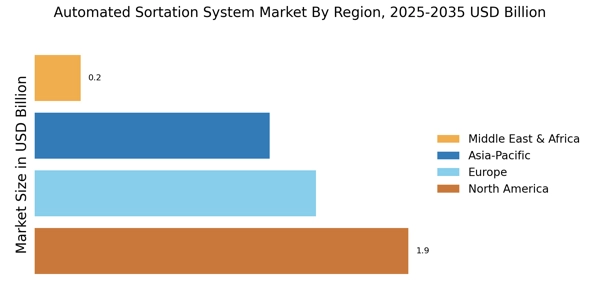

The Automated Sortation System Market is significantly influenced by the rapid growth of the e-commerce and retail sectors. As online shopping continues to gain traction, the need for efficient order fulfillment and inventory management becomes paramount. Recent statistics indicate that e-commerce sales are expected to reach over 6 trillion dollars by 2024, necessitating robust sorting solutions to handle the increasing volume of orders. Automated sortation systems provide the necessary infrastructure to manage this demand, ensuring timely and accurate deliveries. Retailers are increasingly investing in these systems to enhance their operational capabilities, thereby driving the growth of the Automated Sortation System Market. This trend underscores the critical role of automation in meeting the evolving needs of consumers in a digital marketplace.

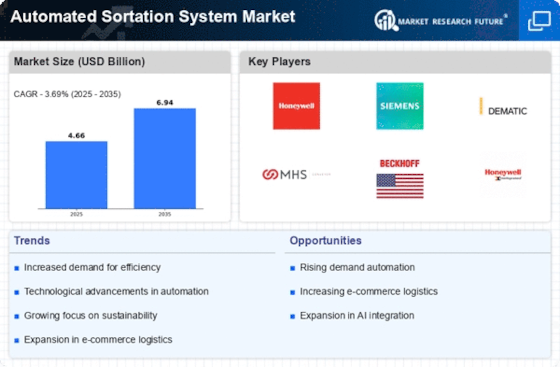

Technological Advancements in Automation

Technological advancements play a pivotal role in shaping the Automated Sortation System Market. Innovations in robotics, artificial intelligence, and machine learning are revolutionizing the capabilities of sortation systems. These technologies enable systems to adapt to varying product types and volumes, enhancing flexibility and efficiency. For instance, the introduction of vision systems allows for improved item recognition and sorting accuracy. Market data suggests that the adoption of advanced technologies in sortation systems could lead to a reduction in operational errors by up to 30%. As companies seek to leverage these advancements to optimize their operations, the demand for sophisticated automated sortation systems is likely to increase, further propelling the market forward.

Rising Demand for Efficiency in Logistics

The Automated Sortation System Market is experiencing a notable surge in demand for enhanced efficiency within logistics operations. Companies are increasingly recognizing the need to streamline their supply chains to reduce operational costs and improve delivery times. According to recent data, the logistics sector is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years. This growth is driving investments in automated sortation systems, which can process large volumes of items swiftly and accurately. As businesses strive to meet consumer expectations for faster shipping, the integration of automated sortation systems becomes essential. This trend indicates a shift towards automation as a strategic priority, positioning the Automated Sortation System Market for substantial growth in the coming years.

Regulatory Compliance and Safety Standards

The Automated Sortation System Market is also influenced by the increasing emphasis on regulatory compliance and safety standards. As industries face stricter regulations regarding workplace safety and operational efficiency, the adoption of automated sortation systems becomes a strategic necessity. These systems are designed to enhance safety by minimizing human intervention in potentially hazardous sorting processes. Compliance with safety regulations can lead to reduced liability and improved employee morale. Furthermore, companies that invest in automated solutions are often viewed more favorably by regulatory bodies, which can enhance their market reputation. As the landscape of regulatory requirements continues to evolve, the demand for automated sortation systems is likely to grow, reflecting a broader commitment to safety and compliance in operational practices.