Advancements in Robotics and Automation

Technological advancements in robotics and automation are significantly influencing the Automated Liquid Handling Technologies Market. Innovations in robotic systems have led to the development of more sophisticated liquid handling platforms that can perform complex tasks with minimal human intervention. These advancements not only enhance the efficiency of laboratory processes but also reduce operational costs. For instance, the integration of robotic arms and automated pipetting systems allows for high-throughput screening, which is essential in drug discovery and development. Market data indicates that the adoption of robotic liquid handling systems is expected to increase, driven by the need for faster and more reliable laboratory results. As laboratories seek to optimize their workflows, the demand for advanced automated liquid handling technologies is likely to rise, further stimulating market growth.

Growing Adoption of Personalized Medicine

The growing adoption of personalized medicine is emerging as a key driver of the Automated Liquid Handling Technologies Market. As healthcare shifts towards more individualized treatment approaches, the need for precise and efficient liquid handling solutions becomes increasingly apparent. Automated liquid handling technologies enable researchers to conduct complex assays and experiments that are essential for developing personalized therapies. The market is witnessing a surge in demand for these technologies, as they facilitate the analysis of large volumes of biological samples with high accuracy. Data suggests that the personalized medicine market is expected to expand significantly, with a projected growth rate of around 15% over the next few years. This trend is likely to propel the adoption of automated liquid handling systems, as laboratories seek to enhance their capabilities in supporting personalized medicine initiatives.

Regulatory Compliance and Quality Control

Regulatory compliance and quality control are critical factors driving the Automated Liquid Handling Technologies Market. Laboratories are increasingly required to adhere to stringent regulations and quality standards, particularly in the pharmaceutical and clinical research sectors. Automated liquid handling systems play a vital role in ensuring compliance by providing accurate and reproducible results, which are essential for meeting regulatory requirements. The implementation of these technologies helps laboratories maintain high standards of quality control, thereby reducing the risk of errors and enhancing overall operational efficiency. Market analysis indicates that the demand for automated solutions is likely to grow as organizations prioritize compliance and quality assurance in their processes. This trend underscores the importance of automated liquid handling technologies in supporting laboratories to meet regulatory expectations while optimizing their workflows.

Increased Focus on Drug Discovery and Development

The heightened focus on drug discovery and development is a significant driver of the Automated Liquid Handling Technologies Market. As pharmaceutical companies strive to bring new therapies to market more efficiently, the need for high-throughput screening and precise liquid handling becomes paramount. Automated liquid handling technologies facilitate the rapid processing of samples, enabling researchers to conduct experiments at an accelerated pace. Recent statistics suggest that the pharmaceutical sector is investing heavily in automation, with projections indicating a market growth rate of around 12% in the coming years. This investment is largely driven by the necessity to streamline research processes and improve the accuracy of experimental results. Consequently, the demand for automated liquid handling solutions is expected to surge, reflecting the industry's commitment to innovation and efficiency.

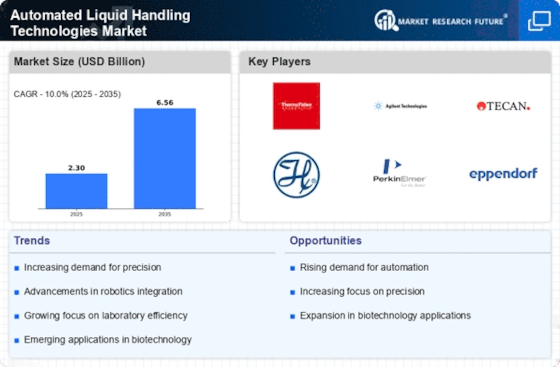

Rising Demand for Precision in Laboratory Processes

The increasing need for precision in laboratory processes is a primary driver of the Automated Liquid Handling Technologies Market. As research and development activities expand across various sectors, including pharmaceuticals and biotechnology, the demand for accurate and reproducible results intensifies. Automated liquid handling systems offer enhanced precision, reducing human error and ensuring consistent sample preparation. According to recent data, the market for automated liquid handling technologies is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is largely attributed to the rising complexity of laboratory workflows, which necessitate advanced solutions to maintain accuracy and efficiency. Consequently, laboratories are increasingly adopting automated systems to streamline their operations, thereby propelling the market forward.