E-commerce Growth

The Global Automated Dispensing Machines Market Industry is benefiting from the exponential growth of e-commerce, which demands efficient and reliable dispensing solutions. As online shopping continues to rise, retailers are increasingly implementing automated dispensing machines to facilitate quick and accurate order fulfillment. For instance, companies are deploying kiosks and vending solutions that allow customers to retrieve their purchases seamlessly. This trend is particularly evident in urban areas where convenience is paramount. The integration of automated systems in e-commerce operations is likely to drive market growth, contributing to the projected increase in market value from 36.9 USD Billion in 2024 to 103.4 USD Billion by 2035.

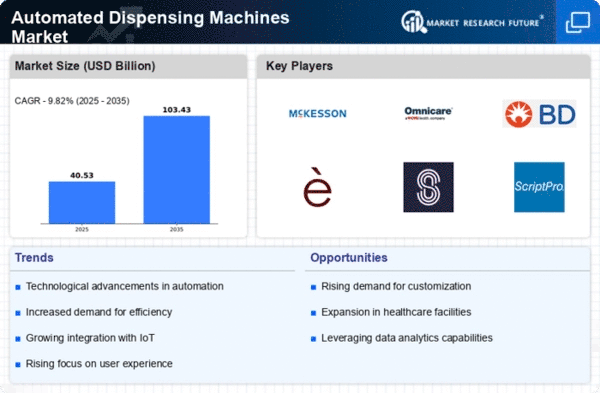

Market Growth Projections

The Global Automated Dispensing Machines Market Industry is projected to experience substantial growth over the coming years. The market value is expected to escalate from 36.9 USD Billion in 2024 to an impressive 103.4 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 9.82% from 2025 to 2035, reflecting the increasing adoption of automated dispensing solutions across various sectors. The demand for efficiency, accuracy, and improved customer experiences is likely to drive this expansion, positioning automated dispensing machines as a critical component in the evolving landscape of retail pharmacy and healthcare.

Technological Advancements

The Global Automated Dispensing Machines Market Industry is experiencing rapid technological advancements that enhance operational efficiency and user experience. Innovations such as artificial intelligence and IoT integration are enabling machines to optimize inventory management and reduce human error. For instance, smart dispensing systems can monitor stock levels in real-time, ensuring timely replenishment. These advancements not only streamline operations but also improve customer satisfaction by providing faster service. As a result, the market is projected to grow from 36.9 USD Billion in 2024 to 103.4 USD Billion by 2035, indicating a robust demand driven by technological evolution.

Rising Demand in Healthcare

The Global Automated Dispensing Machines Market Industry is significantly influenced by the increasing demand for automation in healthcare settings. Hospitals and pharmacies are adopting automated dispensing solutions to enhance medication management and reduce the risk of errors. For example, automated pharmacy systems can dispense medications accurately and efficiently, improving patient safety. The growing emphasis on patient-centric care and the need for operational efficiency are driving this trend. Consequently, the market is expected to witness a compound annual growth rate of 9.82% from 2025 to 2035, reflecting the healthcare sector's commitment to adopting advanced dispensing technologies.

Regulatory Support and Standards

The Global Automated Dispensing Machines Market Industry is supported by favorable regulatory frameworks and standards that promote the adoption of automated solutions. Governments and regulatory bodies are increasingly recognizing the benefits of automation in enhancing safety and efficiency in various sectors. For instance, guidelines that encourage the use of automated dispensing systems in pharmacies and hospitals are becoming more prevalent. This regulatory support not only fosters innovation but also instills confidence among stakeholders regarding the safety and efficacy of automated solutions. As a result, the market is poised for growth, driven by the alignment of industry practices with regulatory expectations.

Increased Focus on Operational Efficiency

The Global Automated Dispensing Machines Market Industry is propelled by a heightened focus on operational efficiency across various sectors. Businesses are recognizing the potential of automated dispensing solutions to minimize labor costs and enhance productivity. By automating the dispensing process, organizations can allocate human resources to more strategic tasks, thereby improving overall efficiency. This trend is particularly relevant in retail and healthcare, where time and accuracy are critical. As companies seek to streamline operations, the market is anticipated to grow significantly, with a CAGR of 9.82% projected from 2025 to 2035, reflecting the ongoing shift towards automation.