Rising Labor Costs

The automated dispensing-machines market is experiencing growth due to the rising labor costs in the United States. As businesses seek to optimize operational efficiency, the adoption of automated solutions becomes increasingly attractive. Labor costs have escalated, with average hourly wages rising by approximately 3.5% annually. This trend compels organizations to invest in automated dispensing machines, which can reduce the need for manual labor and streamline operations. By automating dispensing processes, companies can minimize human error and enhance productivity. The shift towards automation is particularly evident in sectors such as retail and healthcare, where efficiency is paramount. Consequently, the automated dispensing-machines market is likely to expand as businesses look for cost-effective solutions to manage labor expenses.

Regulatory Compliance

Regulatory compliance is increasingly influencing the automated dispensing-machines market, particularly in sectors such as healthcare and pharmaceuticals. Stricter regulations regarding medication dispensing and inventory management are prompting healthcare providers to adopt automated solutions. These machines not only ensure compliance with safety standards but also enhance traceability and accountability in dispensing processes. The market is responding to this need, with a notable increase in the deployment of automated dispensing machines in hospitals and pharmacies. As regulatory frameworks continue to evolve, the demand for compliant dispensing solutions is expected to drive growth in the automated dispensing-machines market.

Expansion of E-commerce

The expansion of e-commerce is significantly impacting the automated dispensing-machines market. As online shopping continues to grow, businesses are exploring innovative ways to fulfill customer orders efficiently. Automated dispensing machines serve as a bridge between online and offline shopping experiences, allowing consumers to pick up their purchases conveniently. This trend is underscored by the fact that e-commerce sales in the US have increased by over 15% annually. Retailers are increasingly investing in automated dispensing solutions to enhance customer satisfaction and streamline order fulfillment processes. Consequently, the automated dispensing-machines market is poised for growth as e-commerce continues to reshape consumer purchasing behaviors.

Technological Integration

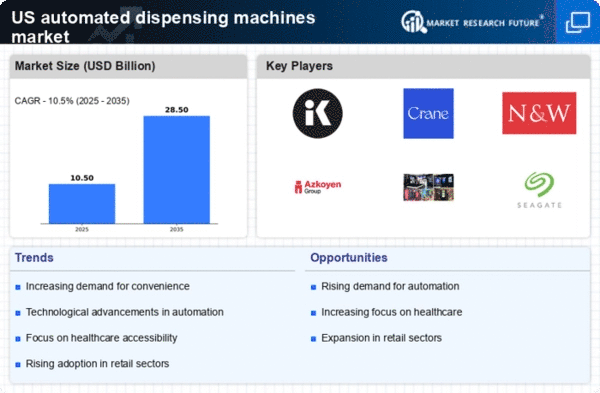

The integration of advanced technologies is a key driver of the automated dispensing-machines market. Innovations such as artificial intelligence (AI), machine learning, and IoT are enhancing the functionality and efficiency of these machines. For instance, AI can optimize inventory management by predicting demand patterns, while IoT enables real-time monitoring of machine performance. This technological evolution is reflected in the market, which is projected to grow at a CAGR of 12% over the next five years. As companies recognize the benefits of integrating these technologies into their dispensing solutions, the automated dispensing-machines market is likely to see increased investment and adoption across various sectors.

Consumer Preference for Convenience

Consumer preferences are shifting towards convenience, significantly impacting the automated dispensing-machines market. In an era where instant access to products and services is expected, automated dispensing machines offer a solution that aligns with this demand. The market is witnessing a surge in installations in locations such as shopping malls, airports, and universities, where consumers seek quick and easy access to items. This trend is supported by data indicating that 70% of consumers prefer self-service options for purchasing everyday items. As convenience becomes a priority, businesses are increasingly investing in automated dispensing machines to cater to this evolving consumer behavior, thereby driving market growth.