Nicotine Gum Market Summary

As per Market Research Future analysis, the Nicotine Gum Market Size was estimated at 1.632 USD Billion in 2024. The Nicotine Gum industry is projected to grow from 1.707 USD Billion in 2025 to 2.676 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Nicotine Gum Market is experiencing a dynamic shift driven by health consciousness and innovative product offerings.

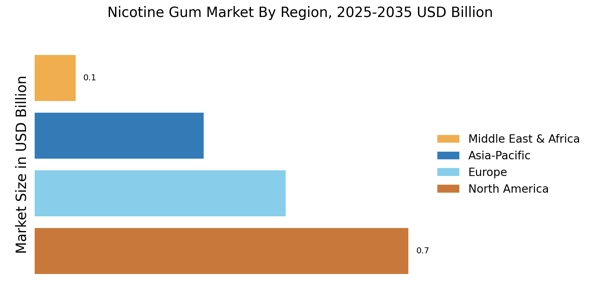

- Health consciousness is significantly driving demand for nicotine gum, particularly in North America, the largest market.

- Flavor innovations are enhancing user experience, with flavored segments dominating sales while plain varieties are growing rapidly.

- Regulatory changes are shaping market dynamics, particularly in the Asia-Pacific region, which is the fastest-growing market.

- Key market drivers include rising health awareness and regulatory support for smoking cessation products, fueling growth in both the 4mg and flavored segments.

Market Size & Forecast

| 2024 Market Size | 1.632 (USD Billion) |

| 2035 Market Size | 2.676 (USD Billion) |

| CAGR (2025 - 2035) | 4.6% |

Major Players

Reynolds American Inc (US), Philip Morris International Inc (US), British American Tobacco plc (GB), Altria Group Inc (US), Japan Tobacco Inc (JP), Imperial Brands plc (GB), Swedish Match AB (SE), Nicorette (US)