Astaxanthin Market Summary

As per Market Research Future analysis, the Astaxanthin Market Size was estimated at 1.998449191 USD Billion in 2024. The Astaxanthin industry is projected to grow from 2.2 USD Billion in 2025 to 6.1 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 10.7% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Astaxanthin Market is experiencing robust growth driven by rising demand for natural ingredients and preventive health measures.

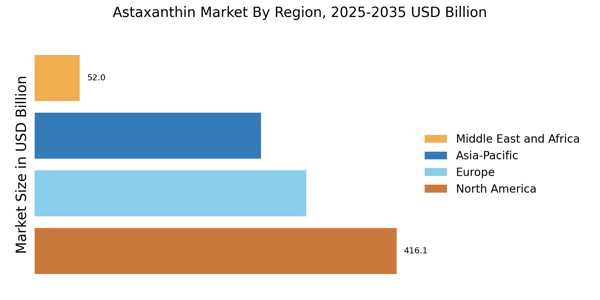

- The North American region remains the largest market for astaxanthin, reflecting a strong consumer preference for natural health products.

- In contrast, the Asia-Pacific region is identified as the fastest-growing market, driven by increasing health consciousness among consumers.

- The natural segment dominates the market, while the synthetic segment is witnessing rapid growth due to advancements in production technologies.

- Key market drivers include growing awareness of health benefits and rising demand for sustainable sourcing, which are shaping the industry's future.

Market Size & Forecast

| 2024 Market Size | 1.998449191 (USD Billion) |

| 2035 Market Size | 6.1 (USD Billion) |

| CAGR (2025 - 2035) | 10.7% |

Major Players

Cyanotech Corporation (US), Algatechnologies Ltd. (IL), AstaReal AB (SE), Fuji Chemical Industry Co., Ltd. (JP), Kemin Industries, Inc. (US), BASF SE (DE), Zhejiang Medicine Co., Ltd. (CN), Nutraceutical Corporation (US), E.I. du Pont de Nemours and Company (US)