Increased Focus on Sustainability

The Asset Financing Platform Market is increasingly aligning with sustainability goals, as both consumers and businesses prioritize environmentally friendly practices. Financial institutions are now more inclined to support projects that promote sustainability, such as renewable energy initiatives and green technology investments. This shift is reflected in the growing number of asset financing platforms that offer specialized products for sustainable projects. Recent statistics indicate that the market for green financing is expected to grow by 20% annually, highlighting the potential for asset financing platforms to capitalize on this trend. As sustainability becomes a core value for many organizations, the demand for eco-friendly financing solutions is likely to rise.

Regulatory Support for Asset Financing

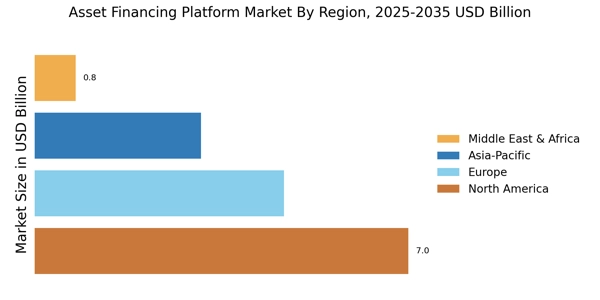

The Asset Financing Platform Market benefits from increasing regulatory support aimed at fostering innovation and competition. Governments are recognizing the importance of asset financing in stimulating economic growth and are implementing policies that encourage the development of financing platforms. For example, regulatory frameworks that simplify the approval process for asset-backed loans are emerging, which could enhance market participation. Data suggests that regions with supportive regulatory environments have seen a 15% increase in new financing platforms entering the market. This regulatory backing not only boosts investor confidence but also facilitates the growth of diverse financing options for consumers.

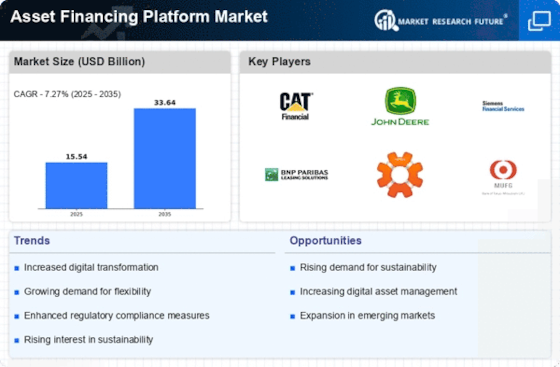

Rising Demand for Flexible Financing Options

The Asset Financing Platform Market is witnessing a notable increase in demand for flexible financing options. Businesses and individuals are increasingly seeking tailored financing solutions that align with their specific needs and cash flow patterns. This shift is driven by the growing recognition that traditional financing models may not adequately address the diverse requirements of modern consumers. Market data indicates that platforms offering customizable financing terms are gaining traction, with a reported increase in user engagement by 25% over the past year. This trend suggests that flexibility in financing options is becoming a critical driver for success in the asset financing sector.

Technological Advancements in Asset Financing

The Asset Financing Platform Market is experiencing a surge in technological advancements, which are reshaping the landscape of financing solutions. Innovations such as artificial intelligence, machine learning, and blockchain technology are enhancing the efficiency and transparency of asset financing transactions. For instance, AI algorithms can analyze vast datasets to assess creditworthiness, thereby streamlining the approval process. According to recent data, the integration of these technologies is projected to increase operational efficiency by up to 30%. This trend not only reduces costs for lenders but also improves the customer experience, making asset financing more accessible to a broader audience.

Growing Awareness of Alternative Financing Solutions

The Asset Financing Platform Market is experiencing a shift in consumer awareness regarding alternative financing solutions. As traditional banking methods become less favorable due to stringent lending criteria, more individuals and businesses are exploring asset financing platforms as viable alternatives. This trend is supported by a growing body of evidence indicating that alternative financing options can provide quicker access to funds and more favorable terms. Recent surveys reveal that approximately 40% of small businesses are now considering asset financing as a primary source of funding. This increasing awareness is likely to drive further growth in the asset financing sector, as more consumers seek out innovative financing solutions.