North America : Established Financial Ecosystem

The North American MSME financing market is projected to reach $1,015.0 million by December 2025, driven by a strong demand for innovative financing solutions and supportive regulatory frameworks. The region benefits from a well-established financial ecosystem, with increasing investments in technology and digital platforms enhancing access to funding for MSMEs. Regulatory initiatives aimed at promoting entrepreneurship and small business growth further catalyze market expansion.

Leading countries such as the United States and Canada dominate the market, with key players like Kiva, Lendio, and OnDeck providing diverse financing options. The competitive landscape is characterized by a mix of traditional banks and fintech companies, fostering innovation and improving service delivery. The presence of established institutions ensures a robust support system for MSMEs, contributing to the region's significant market share.

Europe : Diverse Financing Landscape

The European MSME financing market is expected to reach €850.0 million by December 2025, fueled by increasing demand for tailored financial products and supportive government policies. The region's diverse economic landscape encourages innovation and entrepreneurship, with various initiatives aimed at enhancing access to finance for small businesses. Regulatory frameworks are evolving to support MSMEs, ensuring a conducive environment for growth and sustainability.

Countries like Germany, France, and the UK are at the forefront of this market, with key players such as Funding Circle and various local banks actively participating. The competitive landscape is marked by a blend of traditional banks and emerging fintech solutions, providing a wide array of financing options. This dynamic environment fosters collaboration and innovation, positioning Europe as a significant player in The MSME Financing.

Asia-Pacific : Emerging Powerhouse in Financing

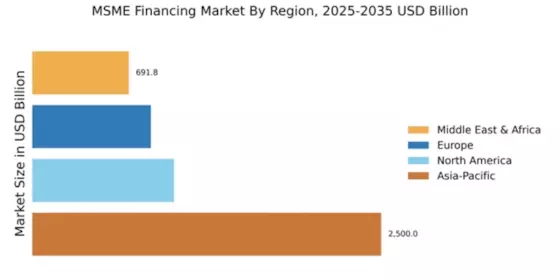

The Asia-Pacific region is set to dominate the MSME financing market, with a projected size of $2,500.0 million by December 2025. This growth is driven by rapid economic development, increasing digitalization, and a strong focus on supporting small and medium enterprises. Governments across the region are implementing favorable policies and initiatives to enhance access to finance, thereby stimulating demand for MSME financing solutions.

Countries like India, China, and Australia are leading the charge, with major players such as State Bank of India, HDFC Bank, and ICICI Bank playing pivotal roles in providing financing options. The competitive landscape is characterized by a mix of traditional banks and innovative fintech companies, ensuring a diverse range of products and services. This dynamic environment positions Asia-Pacific as a key player in The MSME Financing.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) MSME financing market is projected to reach $691.77 million by December 2025, driven by increasing recognition of the importance of small businesses in economic development. The region is witnessing a surge in initiatives aimed at improving access to finance for MSMEs, supported by both governmental and non-governmental organizations. Regulatory frameworks are gradually evolving to create a more favorable environment for small business growth.

Countries like South Africa, Nigeria, and the UAE are leading the market, with key players such as local banks and microfinance institutions actively participating. The competitive landscape is diverse, with a mix of traditional financing options and innovative solutions emerging to meet the needs of MSMEs. This growth potential positions MEA as an attractive market for investors and financial institutions looking to tap into the burgeoning MSME sector.