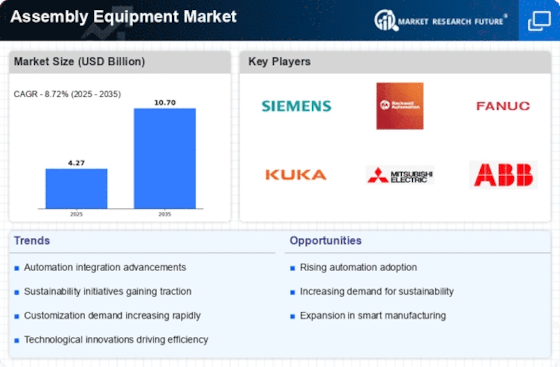

Leading market players are investing heavily in the research and development in order to expand their product lines, which will help the Assembly Equipment Market grow even more. Market players are also undertaking a variety of strategic activities to spread their global footprint, with important market developments including mergers and acquisitions, new product launches, contractual agreements, higher investments, and collaboration with other organizations. To spread and survive in a more competitive and rising market climate, the Assembly Equipment industry must offer cost-effective items.

Manufacturing locally to minimize the operational costs is one of the key business tactics used by the manufacturers in the global Assembly Equipment industry to benefit the clients and increase the market sector. In recent years, the Assembly Equipment industry has offered some of the most significant advantages to several industries.

Major players in the Assembly Equipment Market, including AlsilMaterial, Applied Materials Inc., ASML Holdings N.V., Intel Corporation, Micron Technology Inc., Qualcomm Technologies, Inc., Samsung Group, Screen Holdings Co., Ltd., Teradyne Inc., Tokyo Electron Limited, and others, are trying to increase market demand by investing in the research and development operations.

ASM Pacific Technology is a multinational company that provides assembly and packaging solutions for the semiconductor and electronics industries. It is based in Hong Kong and is a leading supplier of equipment and solutions for the semiconductor and electronics assembly industries. ASM Pacific Technology is known for its focus on innovation and technological advancements in semiconductor assembly and electronics manufacturing equipment and serves a wide range of industries, including automotive, consumer electronics, the telecommunications, and industrial applications.

ASM Pacific Technology (ASMPT), a leading supplier of semiconductor assembly and packaging equipment, announced the acquisition of Xact Robotics, a developer of artificial intelligence (AI)-powered robotic solutions for the electronics manufacturing industry. The acquisition will allow ASMPT to integrate Xact Robotics' AI-powered solutions into its own products, offering customers more intelligent and automated assembly solutions.

KLA Corporation, headquartered in Milpitas, California, is a technology company that provides inspection, measurement, and control solutions for the semiconductor and electronics industries. KLA Corporation primarily serves the semiconductor industry, but its solutions also have applications in areas such as data storage, LED, and other high-tech industries. The company is known for its advanced technology and innovation in areas like optical inspection, e-beam inspection, metrology, and process control, contributing to the development of cutting-edge semiconductor manufacturing processes.

KLA Corporation and Teradyne, Inc., two leading suppliers of semiconductor manufacturing equipment, announced a partnership to develop and deploy integrated solutions for the semiconductor assembly and packaging market. The partnership will combine KLA's expertise in wafer inspection and metrology with Teradyne's expertise in test equipment to offer customers more comprehensive and efficient assembly and packaging solutions.