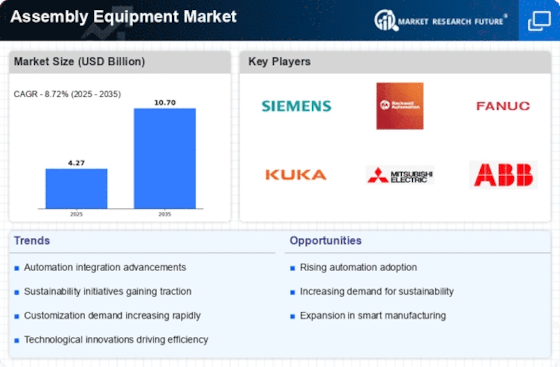

Top Industry Leaders in the Assembly Equipment Market

The Competitive Landscape of the Assembly Equipment Market

The assembly equipment market, acts as the maestro behind flawlessly assembled products, from sleek smartphones to intricate medical devices. These crucial machines meticulously guide components, fasten parts, and orchestrate intricate processes, ensuring consistent quality and efficiency across diverse industries. Navigating the dynamic landscape of this market is crucial for players seeking to secure their position and capitalize on the ever-evolving needs of manufacturers.

Key Players:

- AlsilMaterial

- Applied Materials Inc.

- ASML Holdings N.V.

- Intel Corporation

- Micron Technology Inc.

- Qualcomm Technologies, Inc.

- Samsung Group

- Screen Holdings Co., Ltd.

- Teradyne Inc.

- Tokyo Electron Limited

Strategies Adopted by Leaders

- Technological Prowess: Leading players like Siemens, ASM Assembly Systems, and Yamaha Motor Solutions invest heavily in R&D, pushing boundaries in automation, robotic integration, and data-driven process optimization. They pioneer solutions like modular pick-and-place robots, AI-powered vision systems for defect detection, and real-time production monitoring platforms, offering enhanced flexibility, accuracy, and efficiency.

- Application Focus: Players cater to specific industry segments. Bosch Rexroth excels in high-precision assembly solutions for the automotive industry, while Mycronic Technology focuses on advanced equipment for electronic component placement. This specialization allows for tailored features and deeper expertise in each sector's unique assembly challenges.

- Integrated Systems and Turnkey Solutions: Offering comprehensive packages encompassing robots, controllers, software, and material handling systems simplifies system design and implementation for customers. Companies like Kuka and GE Intelligent Platforms provide complete assembly lines, reducing integration complexity and accelerating production setup.

- Global Footprint: Establishing geographically diverse sales and service networks is crucial for catering to the global nature of manufacturing. ABB and Rockwell Automation maintain strong regional presence across continents, ensuring customer proximity and efficient technical support.

- Strategic Partnerships and Collaborations: Collaborations with technology providers, software developers, and system integrators accelerate innovation and broaden market reach. For instance, partnerships between assembly equipment companies and sensor manufacturers enable integration of real-time production data into process optimization systems.

Factors for Market Share Analysis:

- Equipment Type: Analyzing market share by equipment type (pick-and-place robots, surface mount technology machines, soldering equipment) reveals dominant players in each segment and future growth potential. Pick-and-place robots are expected to see the fastest growth due to their versatility and automation capabilities.

- Automation Level: Understanding the needs of different production lines requires consideration of automation levels (fully automated, semi-automated, manual). Companies like Stäubli Robotics cater to high-precision automation, while Universal Robots focuses on flexible cobot solutions for collaborative environments.

- Industry Vertical: The market is driven by diverse sectors like electronics, automotive, and medical devices. Each segment has unique requirements for precision, speed, and cleanroom compatibility, necessitating specialized equipment solutions.

New and Emerging Companies:

- Hanwha Techwin: This South Korean company pioneers high-speed and high-precision assembly solutions for the electronics industry, catering to the growing demand for miniaturized and complex electronic devices.

- Vectronix AG: This Swiss company specializes in automated assembly and inspection systems for the medical device industry, offering solutions for critical applications demanding stringent quality control.

- SOFT Robotics: This American company develops innovative grippers and robotic arms made from soft, compliant materials, enabling gentle handling of delicate components in diverse assembly tasks.

Industry Developments:

Siemens

- June 2023- Announces partnership with KUKA to develop integrated robotic solutions for the automotive industry.

ABB

- May 2023- Launches YuMi 2.0 cobot with enhanced capabilities and easier programming.

Rockwell Automation

- April 2023- Unveils FactoryTalk® v14 platform with advanced analytics and cloud connectivity features.