Regulatory Support

Regulatory support is emerging as a significant driver for the Asia Pacific Polylactic Acid [PLA] Packaging Market. Governments across the region are implementing stringent regulations aimed at reducing plastic waste and promoting sustainable packaging solutions. Initiatives such as bans on single-use plastics and incentives for biodegradable materials are encouraging businesses to transition towards PLA packaging. For instance, several countries in Asia Pacific have introduced policies that favor the use of bioplastics, which is likely to boost the adoption of PLA in various sectors. Market data indicates that regions with supportive regulatory frameworks are experiencing a faster growth rate in PLA packaging adoption, with projections suggesting a potential increase of 20% in market size over the next few years. This regulatory landscape not only fosters innovation but also aligns with global sustainability goals.

Sustainability Focus

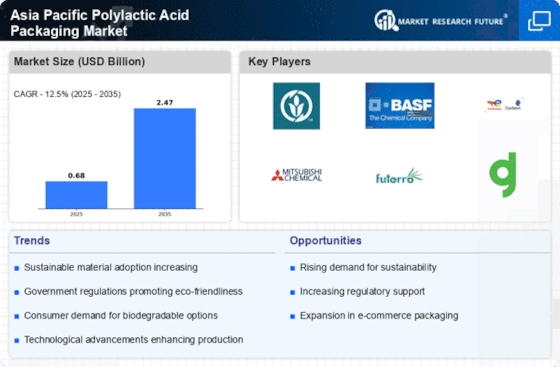

The increasing emphasis on sustainability is a primary driver for the Asia Pacific Polylactic Acid [PLA] Packaging Market. As consumers become more environmentally conscious, there is a growing demand for biodegradable and compostable packaging solutions. This shift is evident in various sectors, including food and beverage, where companies are actively seeking alternatives to traditional plastic packaging. The Asia Pacific region is witnessing a surge in investments aimed at developing sustainable packaging materials, with PLA being at the forefront due to its renewable nature. Market data indicates that the demand for sustainable packaging is projected to grow at a compound annual growth rate (CAGR) of over 10% in the coming years, further solidifying PLA's position in the packaging landscape. This trend not only aligns with consumer preferences but also encourages manufacturers to innovate and adopt eco-friendly practices.

Investment in Bioplastics

Investment in bioplastics is a pivotal driver for the Asia Pacific Polylactic Acid [PLA] Packaging Market. With the increasing recognition of the environmental benefits of bioplastics, investors are channeling funds into the development and production of PLA materials. This influx of capital is facilitating advancements in production technologies and expanding the capacity for PLA manufacturing. Market data indicates that investments in bioplastics are projected to reach USD 5 billion by 2027, with a significant portion allocated to PLA packaging solutions. This financial backing is likely to enhance the competitiveness of PLA in the packaging sector, as manufacturers are better equipped to innovate and meet the rising demand for sustainable alternatives. As investment continues to grow, the PLA packaging market is poised for substantial expansion, potentially doubling its market size within the next decade.

Technological Advancements

Technological advancements play a crucial role in shaping the Asia Pacific Polylactic Acid [PLA] Packaging Market. Innovations in production processes and material formulations are enhancing the performance characteristics of PLA, making it a more viable option for various applications. Recent developments in biopolymer technology have led to improved barrier properties and thermal resistance of PLA, expanding its usability in packaging. Furthermore, advancements in recycling technologies are facilitating the recovery and reuse of PLA materials, thereby promoting a circular economy. Market data suggests that the introduction of new processing techniques could potentially increase the market share of PLA packaging by 15% over the next five years. As manufacturers continue to invest in research and development, the technological landscape of PLA packaging is expected to evolve, offering more efficient and sustainable solutions.

Consumer Awareness and Demand

Consumer awareness and demand for eco-friendly products are driving the Asia Pacific Polylactic Acid [PLA] Packaging Market. As consumers become more informed about the environmental impact of packaging materials, there is a noticeable shift towards products that utilize sustainable packaging solutions. This trend is particularly pronounced among younger demographics, who are increasingly prioritizing sustainability in their purchasing decisions. Market data reveals that approximately 70% of consumers in the Asia Pacific region are willing to pay a premium for products packaged in environmentally friendly materials, including PLA. This growing consumer preference is prompting manufacturers to adopt PLA packaging as a means to differentiate their products in a competitive market. As awareness continues to rise, the demand for PLA packaging is expected to escalate, potentially leading to a market growth rate of 12% annually.

![Asia Pacific Polylactic Acid [PLA] Packaging Market Research Report—Forecast till 2035 Infographic](/uploads/infographics/Asia-Pacific-Polylactic-Acid-_PLA_-Packaging-Market.jpg)