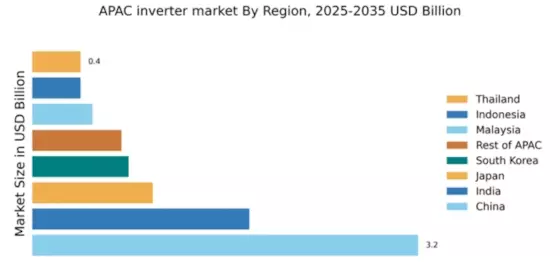

China : Unmatched Growth and Innovation

Key markets include cities like Beijing, Shanghai, and Shenzhen, where demand for solar energy solutions is surging. The competitive landscape features major players like Huawei Technologies and SMA Solar Technology, which dominate the market with innovative products. Local dynamics are characterized by a robust supply chain and a growing emphasis on smart grid technology. The industrial sector, particularly in manufacturing and construction, is increasingly adopting inverter solutions to enhance energy efficiency and sustainability.

India : Government Support Fuels Demand

Key markets include states like Rajasthan, Gujarat, and Maharashtra, where solar installations are booming. The competitive landscape features players like Tata Power and ABB Ltd, which are actively expanding their portfolios. Local dynamics are influenced by a mix of public and private investments, fostering innovation in inverter technology. The agricultural sector is a notable application area, with farmers increasingly adopting solar solutions for irrigation and energy needs.

Japan : Focus on Quality and Efficiency

Key markets include Tokyo and Osaka, where urban solar installations are prevalent. The competitive landscape is dominated by local players like TMEIC Corporation and international firms such as Enphase Energy. The business environment is marked by stringent quality standards and a focus on R&D, driving advancements in inverter technology. The residential sector is a major application area, with homeowners increasingly investing in solar solutions for energy independence.

South Korea : Government Initiatives Drive Growth

Key markets include Seoul and Busan, where solar energy adoption is gaining momentum. The competitive landscape features major players like LG Electronics and Schneider Electric, which are focusing on advanced inverter technologies. Local dynamics are characterized by a strong emphasis on energy efficiency and sustainability. The commercial sector is increasingly adopting solar solutions, driven by corporate sustainability goals and energy cost savings.

Malaysia : Investment in Solar Infrastructure

Key markets include Kuala Lumpur and Penang, where solar energy adoption is on the rise. The competitive landscape features local players and international firms like Fronius International, which are expanding their presence. Local dynamics are influenced by a growing awareness of sustainability and energy efficiency. The residential sector is a significant application area, with homeowners increasingly investing in solar solutions to reduce energy costs.

Thailand : Government Policies Boost Adoption

Key markets include Bangkok and Chiang Mai, where solar installations are gaining traction. The competitive landscape features local companies and international players like SolarEdge Technologies, which are actively expanding their offerings. Local dynamics are characterized by a mix of public and private investments, fostering innovation in inverter technology. The agricultural sector is a notable application area, with farmers adopting solar solutions for irrigation and energy needs.

Indonesia : Focus on Renewable Energy Growth

Key markets include Jakarta and Bali, where solar energy adoption is gaining momentum. The competitive landscape features local players and international firms, which are focusing on expanding their presence. Local dynamics are influenced by a growing awareness of sustainability and energy efficiency. The residential sector is a significant application area, with homeowners increasingly investing in solar solutions to reduce energy costs.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include Vietnam and the Philippines, where solar energy adoption is on the rise. The competitive landscape features a mix of local and international players, each adapting to specific market conditions. Local dynamics are influenced by economic factors and energy policies, creating a complex business environment. The commercial sector is increasingly adopting solar solutions, driven by corporate sustainability goals and energy cost savings.