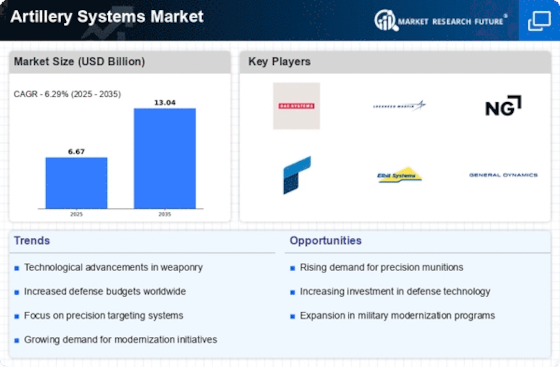

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the artillery systems market grow even more. Market participants are also engaging in a range of strategic initiatives to broaden their reach. Significant market developments include new product launches, contractual agreements, mergers and acquisitions, greater investments, and collaboration with other organisations. To expand and survive in a more competitive and rising market climate, artillery systems industry must offer cost-effective items.Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the artillery systems industry to benefit clients and increase the market sector. In recent years, the artillery systems industry has offered some of the most significant advantages to the market.Major players in the artillery systems market attempting to increase market demand by investing in research and development operations include Avibras (Brazil), BAE Systems (UK), China North Industries Corporation (Norinco) (China), Denel SOC Ltd (South Africa), Elbit Systems (Israel), General Dynamics (US), Hanwha Group (South Korea), IMI Systems (Israel), Kmw+Nexte Defense Systems (Netherlands) and Lockheed Martin (US).Elbit Systems Ltd creates systems and tools for C4ISR (command, control, communications, computers, intelligence, surveillance, and reconnaissance) and aerospace applications. The business sells cutting-edge electro-optic and countermeasures systems, unmanned aircraft systems (UAS), unmanned surface ships, military aircraft, airborne systems, helicopter systems, aerostructures and systems, helmet-mounted systems, and land and naval systems. For homeland security, defense, and commercial aviation markets, Elbit Systems modernizes military platforms and creates new technology.

In March Elbit Systems Ltd. reported receiving contracts for delivering an artillery munitions production line in an Asia-Pacific nation, with an estimated value of about USD 130 million.The contracts will be carried out over 2.5 years.As a leading provider of aerospace and security products and services, Lockheed Martin Corp. conducts research, designs, develops, manufactures, integrates, and maintains technological systems, goods, and services. Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space are the four business segments it conducts.

In September the US Army gave Lockheed Martin a contract worth USD 183 million to produce and provide 28 High Mobility Artillery Rocket System launchers and associated hardware. The first deliveries are expected to start in 2022.