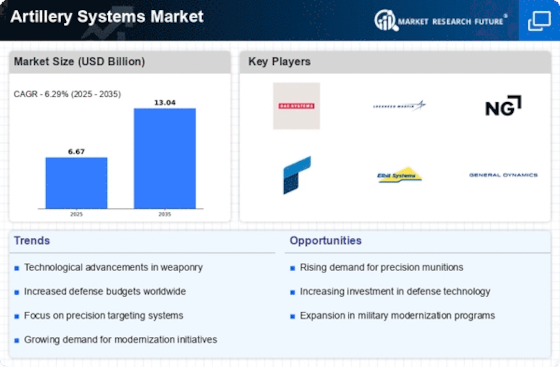

Top Industry Leaders in the Artillery Systems Market

Artillery Systems Market Outlook

Strategies Adopted:

Technological Innovation: Key players invest heavily in research and development to enhance the accuracy, range, and versatility of artillery systems. This includes the development of advanced targeting systems, smart munitions, and autonomous capabilities.

International Collaborations: Strategic partnerships and joint ventures with domestic and international defense organizations are pursued to access new markets, share technology, and pool resources for large-scale projects.

Customization and Modularization: Offering customizable artillery systems that can be tailored to meet the specific requirements of different armed forces. Modular designs allow for easy integration of upgrades and enhancements.

Aftermarket Services: Providing comprehensive aftermarket services, including maintenance, repair, and upgrade solutions, to ensure the long-term reliability and effectiveness of deployed artillery systems.

Key Players:

Avibras (Brazil)

BAE Systems (UK)

China North Industries Corporation (Norinco) (China)

Denel SOC Ltd (South Africa)

Elbit Systems (Israel)

General Dynamics (US)

Hanwha Group (South Korea)

IMI Systems (Israel)

Kmw+NexterDefense Systems (Netherlands)

Lockheed Martin (US)

Factors for Market Share Analysis:

Product Portfolio: The breadth and depth of product offerings, including towed, self-propelled, and rocket artillery systems, influence market share. Companies with diverse portfolios catering to various operational needs are likely to capture a larger market share.

Technological Superiority: The adoption of cutting-edge technologies, such as advanced fire control systems, precision-guided munitions, and network-centric warfare capabilities, can give companies a competitive edge in the market.

Global Presence: Established presence in key markets worldwide, along with strong relationships with defense ministries and procurement agencies, can enhance market share by securing lucrative contracts and partnerships.

Affordability and Lifecycle Costs: Companies that offer cost-effective solutions with low lifecycle costs, including acquisition, operation, and maintenance expenses, are better positioned to compete in price-sensitive markets.

New and Emerging Companies:

KMW + Nexter Defense Systems

NORINCO Group

Bharat Forge Limited

IMI Systems

RUAG Group

ASELSAN A.Ş.

Yugoimport SDPR

Current Company Investment Trends:

Research and Development: Continued investment in R&D to develop next-generation artillery systems with enhanced capabilities, including increased range, precision, and lethality, to meet evolving defense requirements.

Market Expansion: Expansion into emerging markets and diversification of product portfolios to address growing demand for artillery systems in regions experiencing geopolitical tensions and modernization initiatives.

Strategic Acquisitions: Acquisitions of niche technology companies and startups to gain access to cutting-edge technologies and talent, bolstering competitive advantage and market positioning.

Overall Competitive Scenario:

Intense Competition: The artillery systems market is highly competitive, characterized by intense rivalry among key players vying for market share through technological innovation, strategic partnerships, and aggressive marketing.

Market Dynamics: Factors such as increasing defense budgets, geopolitical tensions, and modernization initiatives drive market growth and competition, with companies adapting their strategies to capitalize on emerging opportunities.

Customer Focus: Companies that prioritize customer needs, offer comprehensive solutions, and provide ongoing support services are better positioned to succeed in the competitive artillery systems market by building long-term relationships and trust with defense customers.

Industry News:

September 2022:The Korean Tactical Surface-to-Surface Missile (KTSSM) system will commence mass production in 2023, according to a statement made by Hanwha Corporation on September 22 during the DX Korea 2022 exhibition in Goyang.

December 2021:Australia and South Korea agreed to a deal for Australia to purchase 30 K-9 Thunder self-propelled howitzers. Australia is the seventh nation to purchase the howitzer produced in South Korea.

October 2021:The Netherlands obtained a new order for 155mm illumination and smoke/obscurant artillery shells from Rheinmetall. The projectiles will arrive in the Netherlands in the middle of 2023.