North America : Market Leader in Innovation

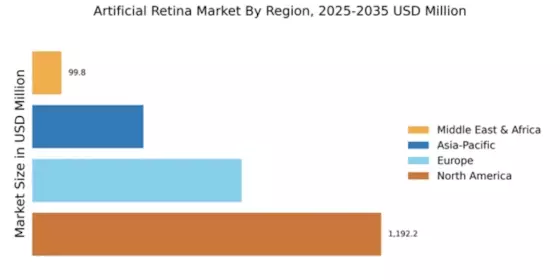

North America is poised to maintain its leadership in the artificial retina market, holding a significant share of 1192.25 million in 2024. The region's growth is driven by advanced healthcare infrastructure, increasing prevalence of retinal diseases, and substantial investments in R&D. Regulatory support from agencies like the FDA further catalyzes innovation, ensuring rapid market entry for new technologies.

The competitive landscape is robust, featuring key players such as Second Sight Medical Products and Abbott Laboratories. The U.S. leads the market, supported by a strong focus on technological advancements and patient-centric solutions. Canada and Mexico are also emerging as important markets, contributing to the overall growth through collaborations and partnerships in the healthcare sector.

Europe : Emerging Market with Potential

Europe's artificial retina market is valued at 715.0 million, reflecting a growing demand for innovative solutions in vision restoration. The region benefits from a strong regulatory framework, with the European Medicines Agency (EMA) actively promoting advancements in medical devices. Increasing awareness of retinal disorders and supportive healthcare policies are key drivers of market growth.

Leading countries include Germany, France, and the UK, where significant investments in healthcare technology are evident. Companies like Pixium Vision and Retina Implant AG are at the forefront, driving innovation and expanding their market presence. The competitive landscape is characterized by collaborations between tech firms and healthcare providers, enhancing the development of artificial retina solutions.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region, with a market size of 380.0 million, is rapidly emerging in the artificial retina sector. Factors such as increasing healthcare expenditure, rising awareness of retinal diseases, and government initiatives to improve healthcare access are propelling market growth. The region is witnessing a shift towards advanced medical technologies, supported by favorable regulatory environments.

Countries like Japan, Australia, and China are leading the charge, with significant contributions from local companies like Bionic Vision Technologies and Nidek Co., Ltd. The competitive landscape is evolving, with a focus on partnerships and collaborations to enhance product offerings and market reach. The growing demand for innovative solutions is expected to drive further advancements in the sector.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) region, with a market size of 99.84 million, presents emerging opportunities in the artificial retina market. Factors such as increasing healthcare investments, rising prevalence of eye disorders, and a growing focus on advanced medical technologies are driving market growth. Regulatory bodies are beginning to establish frameworks to support the introduction of innovative medical devices, enhancing market potential.

Countries like South Africa and the UAE are at the forefront, with increasing collaborations between local and international firms. The presence of key players such as Eyenuk and Alcon is fostering competition and innovation. As healthcare infrastructure improves, the region is expected to see significant advancements in artificial retina technologies, catering to the growing demand for vision restoration solutions.