Artificial Pancreas Device System Size

Artificial Pancreas Device System Market Growth Projections and Opportunities

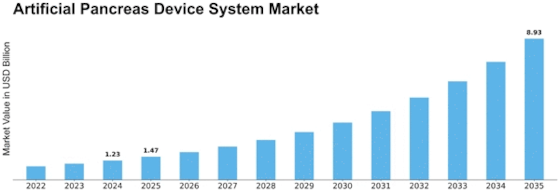

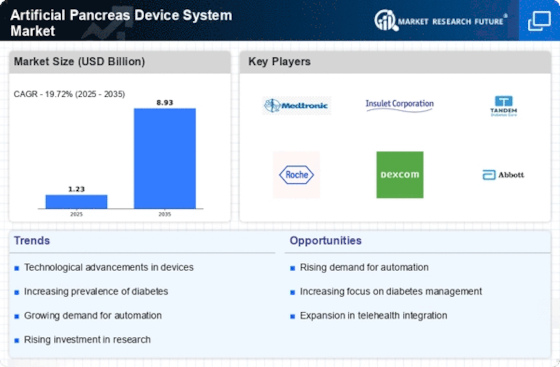

The Artificial Pancreas Device System Market size is expected to increase to over USD 0.4 billion by 2032 rising at a CAGR of 17% from the period of 2023 – 2032. The market for artificial pancreas device system (APDS) is induced by the few competitive forces that lead to growth or decline. The primary factor is a higher level of diabetes prevalence, of which the notable development is type 1 diabetes incidence. In the efforts of the international community to deal with the complicated issues related to the management of diabetes, we are witnessing an increment in the need for novel inventions.

Technological developments have a huge weight and impacts in the structural change of the APDS market. Continual innovation in glucose monitoring sensors, insulin pumps, and closed-loop algorithms assist in making artificial pancreas systems increasingly intelligent and compact. With artificial intelligence and machine learning comes integration which further improves the system on an individual patient basis with respect to glycemic management providing a specific and exact management procedure.

Regulatory considerations consist in one essential element that drive market dynamics of APDS. Those of the strict standards and approvals play crucial roles on the side of the manufacturers to guarantee the safety and validity of devices which are implanted in human bodies. Conformity to regulations is two-fold: it builds the reputation of APDS and it provides credibility which is important to health professionals and patients and which in turn contributes to market growth.

A market dynamic which is supported by economic factors such as healthcare expenditures and reimbursement policies not only will influence dynamics. Financial viability in extending the scope of routine diabetes care to include APDS is determined by the reimbursement systems and the coverage. The economic approach is one of the leading criteria for defining the affordability of such systems for patients. The provider’s ability to adopt these methods is highly dependent on their specific area, primarily in regions where financial feasibility dominates healthcare decision-making projects.

Geographical variations will make different types of market systems having different problems and priorities in diabetes management. Type 1 diabetes is present in different regions, to a greater or lesser extent. Also, the health care infrastructure and patient demographics that vary with the geographical area, influence the demand for APDS. Local manufacturing plays a key role in international trade as producers often work on solutions that fit the specific issues and regulations in different destinations.

Markets and dynamics of competition in the field of APDS serving as a basis for innovation and expansion of markets are seen. The way in which major players, strategic cooperation and production & market shares sharing impact product development and commercialization tactics should be considered. Healthy competition allows new functions, better usability, and upgraded connectivity parameters that means heavy choice of APDS for user or doctors to provide the best care.

Leave a Comment