Rising Awareness and Education

Increased awareness regarding heart health and arrhythmias is driving the Global Arrhythmia Monitoring Devices Market Industry. Educational initiatives by health organizations and governments aim to inform the public about the risks associated with arrhythmias and the importance of early detection. Campaigns promoting heart health have led to more individuals seeking medical advice and monitoring solutions. This heightened awareness is likely to result in increased adoption of arrhythmia monitoring devices, as patients become more proactive in managing their health. Consequently, this trend is expected to bolster market growth significantly in the coming years.

Increasing Geriatric Population

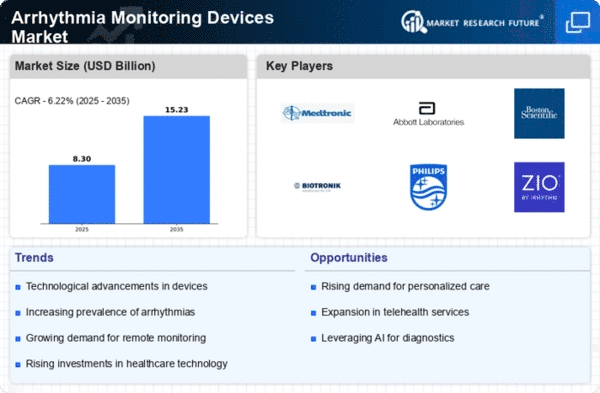

The global demographic shift towards an aging population significantly influences the Global Arrhythmia Monitoring Devices Market Industry. Older adults are more susceptible to arrhythmias, necessitating continuous monitoring to prevent severe complications. According to the United Nations, the number of people aged 65 and older is projected to reach 1.5 billion by 2050. This demographic trend underscores the need for effective arrhythmia management solutions. As healthcare systems adapt to cater to this growing population, the demand for monitoring devices is likely to surge, contributing to a compound annual growth rate of 6.07% from 2025 to 2035.

Rising Prevalence of Cardiac Disorders

The increasing incidence of cardiac disorders globally is a primary driver of the Global Arrhythmia Monitoring Devices Market Industry. As cardiovascular diseases continue to rise, the demand for effective monitoring solutions becomes more pronounced. For instance, the World Health Organization indicates that cardiovascular diseases are the leading cause of death worldwide, accounting for approximately 32% of all deaths. This alarming trend necessitates advanced monitoring devices to manage arrhythmias effectively. The market is projected to reach 5.6 USD Billion in 2024, reflecting the urgent need for innovative solutions to address this growing health crisis.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are vital drivers of the Global Arrhythmia Monitoring Devices Market Industry. Governments and health authorities are increasingly recognizing the importance of arrhythmia monitoring in improving patient outcomes. As a result, they are implementing policies that facilitate the approval and reimbursement of innovative monitoring devices. This regulatory support encourages manufacturers to invest in research and development, leading to the introduction of advanced technologies. Such initiatives not only enhance market accessibility but also stimulate growth, as healthcare providers are more likely to adopt devices that are financially supported by insurance plans.

Technological Advancements in Monitoring Devices

Technological innovations play a crucial role in shaping the Global Arrhythmia Monitoring Devices Market Industry. The development of advanced wearable devices, mobile health applications, and remote monitoring systems enhances patient engagement and enables real-time data collection. For example, devices equipped with artificial intelligence algorithms can analyze heart rhythms more accurately, leading to timely interventions. These advancements not only improve patient outcomes but also drive market growth. As the industry evolves, the integration of telemedicine and digital health technologies is expected to further propel the market, potentially doubling its value to 10.7 USD Billion by 2035.