Rising Cyber Threats

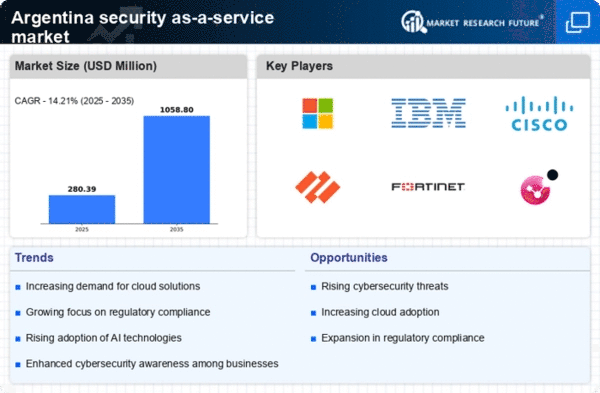

The security as-a-service market in Argentina is growing due to the increasing frequency and sophistication of cyber threats. Organizations are facing a surge in ransomware attacks, phishing schemes, and data breaches, which necessitate robust security measures. In 2025, cybercrime is estimated to cost the global economy over $10 trillion annually. This prompts businesses in Argentina to seek comprehensive security solutions. This trend indicates a heightened awareness of cybersecurity risks, leading to a greater reliance on security as-a-service offerings. As companies prioritize the protection of sensitive data, the demand for scalable and flexible security solutions is likely to rise, further propelling the market forward.

Shift Towards Remote Work

The shift towards remote work arrangements is benefiting the security as-a-service market in Argentina. As more organizations adopt flexible work policies, the need for secure remote access to corporate networks has become paramount. This transition has led to an increased demand for security solutions that can protect data and applications accessed from various locations. Security as-a-service offerings provide the necessary tools to secure remote connections, ensuring that employees can work safely from home or other remote locations. This trend is likely to continue, as businesses recognize the importance of maintaining security in a distributed work environment, thereby driving growth in the security as-a-service market.

Increased Regulatory Pressures

Growing regulatory pressures on data protection and privacy are influencing the security as-a-service market in Argentina. With the implementation of laws such as the Personal Data Protection Law, organizations are compelled to adopt stringent security measures to comply with legal requirements. Failure to adhere to these regulations can result in hefty fines and reputational damage. As a result, businesses are increasingly turning to security as-a-service providers to ensure compliance and mitigate risks. In 2025, it is projected that compliance-related spending in the security sector will account for a significant portion of the overall market, highlighting the importance of regulatory compliance in driving demand for security as-a-service solutions.

Cost Efficiency and Resource Optimization

The need for cost efficiency and resource optimization is driving the security as-a-service market in Argentina. Traditional security solutions often require significant upfront investments in hardware and software, which can be prohibitive for many organizations. In contrast, security as-a-service models offer a subscription-based approach, allowing companies to pay only for the services they need. This flexibility is particularly appealing to small and medium-sized enterprises (SMEs) in Argentina, which may lack the resources for extensive in-house security teams. By leveraging cloud-based security solutions, organizations can reduce operational costs while maintaining high levels of protection, thus contributing to the growth of the security as-a-service market.

Technological Advancements in Security Solutions

Rapid technological advancements in security solutions are propelling the security as-a-service market in Argentina. Innovations such as artificial intelligence (AI), machine learning (ML), and automation are enhancing the capabilities of security services, making them more effective and efficient. These technologies enable real-time threat detection and response, which is crucial in an era of evolving cyber threats. As organizations seek to leverage these advancements, the demand for security as-a-service offerings that incorporate cutting-edge technologies is likely to increase. In 2025, it is anticipated that the integration of AI and ML in security solutions will play a pivotal role in shaping the future of the security as-a-service market.