Rising Cyber Threat Landscape

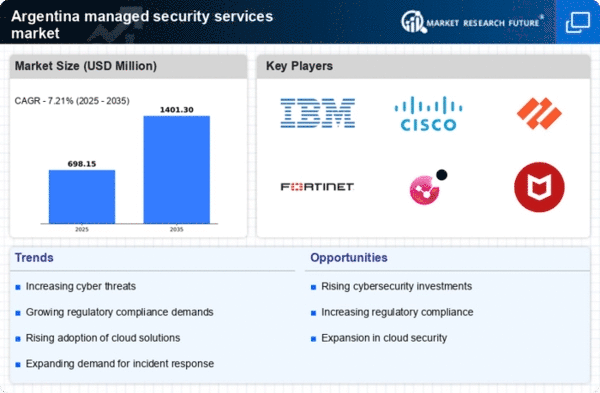

The managed security-services market in Argentina is experiencing growth due to an increasingly complex cyber threat landscape. Cyberattacks have surged, with reports indicating a rise in ransomware and phishing incidents. This escalation compels organizations to seek robust security solutions. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, highlighting the urgency for effective security measures. As businesses recognize the potential financial and reputational damage from breaches, investment in managed security services becomes a priority. The managed security-services market is thus positioned to expand as companies look to mitigate risks and protect sensitive data.

Integration of Compliance Requirements

The managed security-services market in Argentina is influenced by the need for compliance with various regulatory frameworks. Organizations are increasingly required to adhere to data protection laws and industry standards, such as the Personal Data Protection Law. Non-compliance can result in hefty fines and legal repercussions, prompting businesses to invest in managed security services to ensure adherence. The managed security-services market is thus becoming a critical component in helping organizations navigate the complexities of compliance. As regulations evolve, the demand for services that facilitate compliance is likely to increase, driving market growth.

Demand for Cost-Effective Security Solutions

In Argentina, organizations are increasingly seeking cost-effective security solutions to address their cybersecurity needs. The managed security-services market offers scalable options that allow businesses to access advanced security technologies without the burden of significant upfront investments. This trend is particularly relevant for small and medium-sized enterprises (SMEs) that may lack the resources to maintain in-house security teams. By outsourcing security functions, these organizations can focus on core operations while ensuring their systems are protected. The managed security-services market is projected to grow as more companies recognize the financial benefits of outsourcing their security needs.

Shift Towards Cloud-Based Security Solutions

The managed security-services market in Argentina is witnessing a shift towards cloud-based security solutions. As businesses migrate to cloud environments, the need for specialized security services that can protect these infrastructures becomes paramount. Cloud security services offer flexibility and scalability, allowing organizations to adapt to changing security needs. In 2025, it is anticipated that cloud security spending will reach $12 billion in Latin America, indicating a robust growth trajectory. This trend suggests that the managed security-services market will continue to evolve, with providers enhancing their offerings to meet the demands of cloud security.

Increased Focus on Incident Response Capabilities

The managed security-services market in Argentina is increasingly focused on enhancing incident response capabilities. Organizations are recognizing that timely and effective responses to security incidents are crucial in minimizing damage. The demand for managed security services that include incident response planning and execution is on the rise. In 2025, it is estimated that the incident response services segment will account for a significant share of the managed security-services market. This trend indicates a shift towards proactive security measures, as businesses seek to not only prevent attacks but also to respond swiftly when breaches occur.