Government Regulations on Emissions

The Argentine government is implementing stricter regulations on vehicle emissions, which is significantly impacting the electric truck market. These regulations aim to reduce air pollution and promote cleaner transportation options. As a result, companies are incentivized to transition to electric trucks to comply with these new standards. Data indicates that emissions from heavy-duty vehicles account for a substantial portion of urban pollution, prompting regulatory bodies to act. The electric truck market is poised for growth as businesses seek to align with government mandates, thereby fostering a more sustainable transportation ecosystem.

Corporate Sustainability Initiatives

Many companies in Argentina are adopting sustainability initiatives, which significantly influence the electric truck market. As businesses strive to reduce their carbon footprints, the transition to electric trucks becomes a strategic priority. Recent surveys indicate that over 50% of logistics companies are planning to incorporate electric trucks into their fleets by 2026. This trend reflects a broader commitment to environmental responsibility and aligns with consumer preferences for sustainable practices. The electric truck market stands to gain from this corporate shift, as companies seek to enhance their brand image while contributing to environmental goals.

Rising Fuel Costs and Economic Factors

The fluctuation of fuel prices in Argentina has a direct impact on the electric truck market. With traditional fuel costs rising, companies are increasingly looking for cost-effective alternatives. Electric trucks, which typically have lower operational costs, present a compelling solution. Data suggests that electric trucks can reduce fuel expenses by up to 60%, making them an attractive option for fleet operators. This economic shift encourages businesses to transition to electric vehicles, thereby driving growth in the electric truck market. As fuel prices continue to rise, the financial incentives for adopting electric trucks are likely to become even more pronounced.

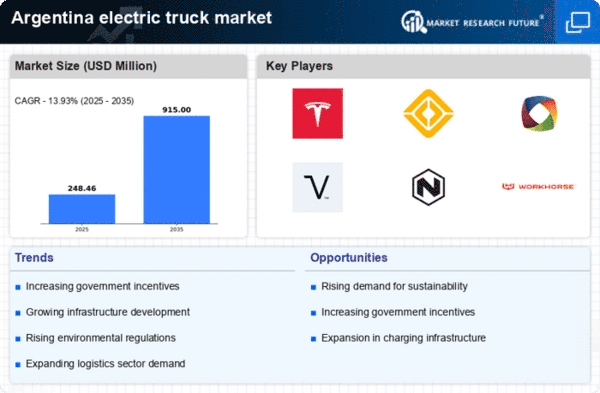

Infrastructure Development for Electric Vehicles

The expansion of charging infrastructure in Argentina plays a crucial role in the electric truck market. As the government invests in charging stations, the accessibility of electric trucks increases, encouraging adoption among logistics companies. Recent data indicates that the number of charging stations has grown by 30% in the last year, facilitating longer routes for electric trucks. This infrastructure development not only supports the operational efficiency of electric trucks but also enhances the overall market appeal. The electric truck market is likely to benefit from this trend, as improved infrastructure reduces range anxiety among potential users, making electric trucks a more viable option for transportation and logistics.

Technological Innovations in Electric Truck Design

Innovations in electric truck design are reshaping the electric truck market in Argentina. Advances in aerodynamics, lightweight materials, and energy-efficient technologies are enhancing the performance and range of electric trucks. For instance, new models are achieving ranges of over 400 km on a single charge, making them more competitive with traditional trucks. This technological progress not only improves the operational capabilities of electric trucks but also attracts interest from various sectors, including logistics and distribution. The electric truck market is likely to see increased investment in research and development as manufacturers strive to meet evolving consumer demands and regulatory standards.