Market Growth Projections

The Global Aprotic Solvents Market Industry is projected to experience substantial growth over the coming years. With an expected market value of 18.1 USD Billion in 2024 and a forecasted increase to 25.2 USD Billion by 2035, the industry is set to expand significantly. The compound annual growth rate of 3.06% from 2025 to 2035 indicates a steady demand for aprotic solvents across various applications. This growth is likely to be driven by factors such as advancements in technology, increasing industrialization, and the rising need for sustainable solutions in chemical processes. The market's trajectory suggests a robust future for aprotic solvents.

Growth in Chemical Manufacturing

The Global Aprotic Solvents Market Industry is poised for growth due to the expanding chemical manufacturing sector. Aprotic solvents are widely utilized in various chemical processes, including polymer production, coatings, and adhesives. The increasing production of specialty chemicals and the rising trend of green chemistry are likely to drive the demand for aprotic solvents. As manufacturers seek efficient and effective solvents for their processes, the market is expected to benefit from this trend. The anticipated compound annual growth rate of 3.06% from 2025 to 2035 suggests a sustained interest in these solvents, indicating their integral role in modern chemical manufacturing.

Rising Demand in Pharmaceuticals

The Global Aprotic Solvents Market Industry is experiencing a notable increase in demand from the pharmaceutical sector. Aprotic solvents are essential in the synthesis of various pharmaceutical compounds, facilitating reactions that require a non-protic environment. This trend is driven by the growing need for innovative drug formulations and the expansion of the pharmaceutical industry. With the market projected to reach 18.1 USD Billion in 2024, the pharmaceutical sector's reliance on aprotic solvents is likely to contribute significantly to this growth. As the industry evolves, the demand for high-purity solvents that meet stringent regulatory standards is expected to rise, further bolstering the market.

Advancements in Battery Technology

The Global Aprotic Solvents Market Industry is significantly influenced by advancements in battery technology, particularly in the production of lithium-ion batteries. Aprotic solvents are critical in the formulation of electrolytes, which are essential for battery performance and efficiency. As the demand for electric vehicles and renewable energy storage solutions continues to rise, the need for high-performance batteries is becoming increasingly important. This trend is expected to drive the demand for aprotic solvents, as manufacturers seek to optimize battery performance. The growth in this sector may contribute to the market's expansion, aligning with the projected increase to 25.2 USD Billion by 2035.

Emerging Markets and Industrialization

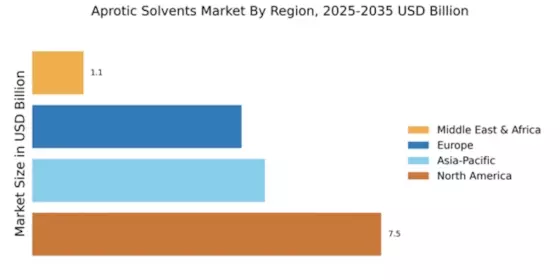

The Global Aprotic Solvents Market Industry is witnessing growth driven by industrialization in emerging markets. As countries develop their manufacturing capabilities, the demand for aprotic solvents is expected to rise across various sectors, including automotive, electronics, and textiles. The increasing investment in infrastructure and manufacturing facilities in these regions is likely to create new opportunities for aprotic solvents. As industries expand and modernize, the need for effective solvents in production processes will become more pronounced. This trend suggests a potential for market growth, as emerging economies seek to enhance their industrial output and competitiveness.

Regulatory Compliance and Safety Standards

The Global Aprotic Solvents Market Industry is shaped by stringent regulatory compliance and safety standards that govern the use of solvents in various applications. As industries become more aware of environmental and health impacts, the demand for solvents that meet these regulations is increasing. Aprotic solvents, often regarded as safer alternatives, are gaining traction in sectors such as coatings and adhesives. The emphasis on sustainability and eco-friendly practices is likely to drive the adoption of aprotic solvents, as companies seek to align with regulatory requirements. This shift may enhance market growth, as businesses prioritize compliance and safety in their operations.