Emergence of Edge Computing

The Application Server Market is witnessing the emergence of edge computing as a transformative trend. As the Internet of Things (IoT) continues to proliferate, the need for processing data closer to the source is becoming increasingly critical. Edge computing enables real-time data processing and analysis, reducing latency and improving application performance. Recent estimates suggest that the edge computing market could reach a valuation of over 15 billion dollars by 2026, indicating a substantial opportunity for application server vendors. This shift is prompting organizations to seek application servers that can effectively support edge computing architectures. As a result, the Application Server Market is likely to evolve, with vendors adapting their solutions to meet the demands of edge computing, thereby enhancing their competitive positioning in the market.

Rising Demand for Scalable Solutions

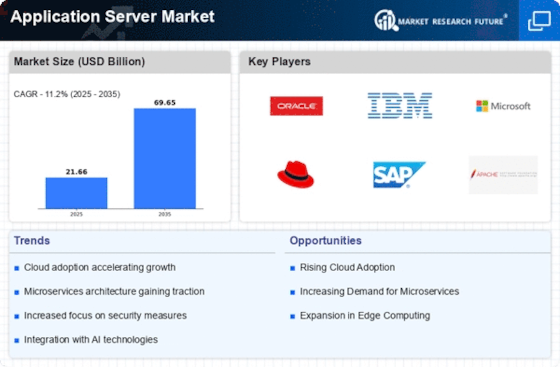

The Application Server Market is experiencing a notable increase in demand for scalable solutions. As businesses expand, they require application servers that can efficiently handle increased workloads and user traffic. This trend is particularly evident in sectors such as e-commerce and online services, where peak traffic can surge dramatically. According to recent data, the market for scalable application servers is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for flexibility and the ability to adapt to changing business requirements. Companies are increasingly seeking application servers that can seamlessly scale up or down, ensuring optimal performance without incurring unnecessary costs. Thus, the emphasis on scalability is likely to remain a key driver in the Application Server Market.

Growing Importance of DevOps Practices

The Application Server Market is increasingly influenced by the growing importance of DevOps practices. As organizations strive for faster software delivery and improved collaboration between development and operations teams, the adoption of DevOps methodologies is becoming more prevalent. This shift is leading to a demand for application servers that support continuous integration and continuous deployment (CI/CD) processes. Recent surveys indicate that over 70% of organizations are implementing DevOps practices, which necessitate robust application server capabilities. Consequently, vendors are focusing on enhancing their application servers to facilitate seamless integration with DevOps tools and processes. This trend is likely to drive innovation and competition within the Application Server Market, as companies seek to improve their operational efficiency and accelerate their software development lifecycles.

Shift Towards Microservices Architecture

The Application Server Market is witnessing a significant shift towards microservices architecture. This architectural style allows organizations to develop applications as a suite of small, independent services, which can be deployed and scaled independently. The adoption of microservices is driven by the need for agility and faster time-to-market, as businesses strive to innovate and respond to customer demands more effectively. Recent studies indicate that nearly 60% of enterprises are either using or planning to adopt microservices in their application development processes. This trend is reshaping the Application Server Market, as traditional monolithic application servers are increasingly being replaced by those that support microservices. Consequently, vendors are adapting their offerings to cater to this evolving landscape, which is likely to enhance competition and drive innovation within the market.

Increased Focus on Hybrid Cloud Solutions

The Application Server Market is experiencing a heightened focus on hybrid cloud solutions. Organizations are increasingly adopting hybrid cloud environments to leverage the benefits of both public and private clouds. This approach allows businesses to maintain control over sensitive data while taking advantage of the scalability and cost-effectiveness of public cloud services. Recent market analysis suggests that the hybrid cloud segment is expected to grow significantly, with projections indicating a market share increase of over 30% in the next few years. As companies seek to optimize their IT infrastructure, the demand for application servers that can seamlessly integrate with hybrid cloud environments is likely to rise. This trend is prompting vendors to enhance their offerings, ensuring compatibility and performance across diverse cloud platforms, thereby driving growth in the Application Server Market.