Emergence of Microservices Architecture

The application server market is being reshaped by the emergence of microservices architecture, which allows for the development of applications as a suite of small, independent services. This architectural shift is gaining traction among US enterprises as it promotes agility and scalability. By November 2025, it is estimated that over 50% of new applications will be built using microservices, necessitating application servers that can efficiently manage these distributed systems. The application server market is evolving to provide solutions that support microservices deployment, enabling organizations to innovate rapidly and respond to customer needs more effectively. This trend is likely to drive further growth in the market as businesses seek to leverage the benefits of microservices.

Rising Demand for Digital Transformation

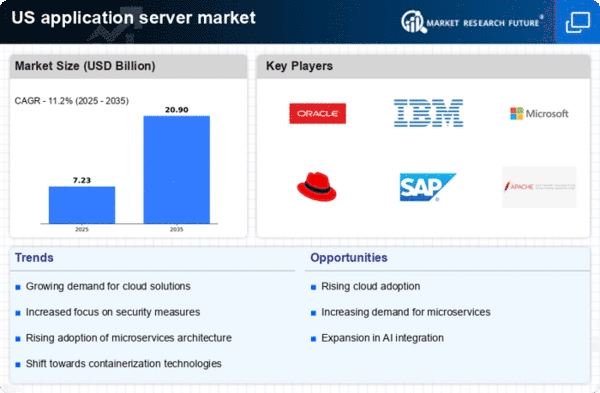

The application server market is experiencing a notable surge in demand driven by the ongoing digital transformation initiatives across various sectors in the US. Organizations are increasingly adopting application servers to enhance their operational efficiency and improve customer engagement. According to recent data, the market is projected to grow at a CAGR of approximately 10% over the next five years. This growth is largely attributed to the need for businesses to modernize their IT infrastructure, enabling them to deploy applications more rapidly and respond to market changes effectively. As companies strive to remain competitive, the application server market is likely to see a significant uptick in investments aimed at upgrading legacy systems and integrating new technologies.

Increased Focus on Hybrid Cloud Solutions

The application server market is witnessing a shift towards hybrid cloud solutions, which combine on-premises infrastructure with cloud services. This trend is fueled by organizations seeking flexibility and scalability in their IT environments. As of November 2025, it is estimated that around 60% of enterprises in the US are utilizing hybrid cloud strategies, which necessitate robust application servers to manage workloads efficiently. The application server market is adapting to this demand by offering solutions that facilitate seamless integration between cloud and on-premises applications. This hybrid approach not only enhances operational agility but also optimizes resource utilization, thereby driving growth in the application server market.

Regulatory Compliance and Data Governance

The application server market is also influenced by the increasing emphasis on regulatory compliance and data governance. Organizations are required to adhere to various regulations, such as GDPR and HIPAA, which necessitate robust data management practices. As of November 2025, compliance-related investments are projected to account for approximately 15% of IT budgets in the US. This trend is driving the application server market to enhance features that support data security, privacy, and compliance. Companies are seeking application servers that not only facilitate data processing but also ensure that data handling practices meet regulatory standards, thereby fostering trust and accountability in their operations.

Growing Importance of Real-Time Data Processing

In the current landscape, the application server market is increasingly focused on real-time data processing capabilities. Businesses are recognizing the value of immediate data insights for decision-making and operational efficiency. As a result, application servers that support real-time analytics are becoming essential. The market is responding to this need by developing servers that can handle high-velocity data streams and provide instant feedback. This trend is particularly evident in sectors such as finance and e-commerce, where timely information can significantly impact performance. The demand for such capabilities is expected to contribute to a substantial increase in the application server market, with projections indicating a growth rate of around 12% in this segment.