Market Share

Application Server Market Share Analysis

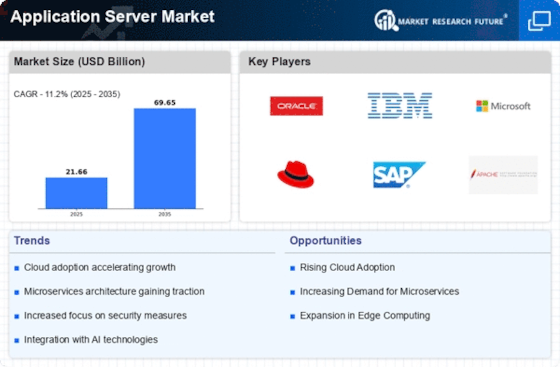

The Application Server market is experiencing great growth and evolving market tendencies. Application Servers are software program frameworks that provide a runtime environment for jogging and coping with programs. One of the important market tendencies within the application server market is the shift closer to cloud-based total solutions. Cloud-based Application Servers offer numerous blessings, which include scalability, flexibility, and price-effectiveness. Another tremendous trend is the adoption of containerization technologies in the Application Server market. Containers offer a lightweight and isolated environment for walking programs, allowing groups to package deals and deploy applications across one-of-a-kind environments without difficulty. Application Servers that help containerization technology, which include Docker and Kubernetes, provide stepped-forward portability, scalability, and resource utilization. Furthermore, there's a growing demand for Application Server answers that support microservices structure. Microservices architecture entails breaking down programs into smaller, impartial offerings that can be evolved, deployed, and scaled, in my opinion. Additionally, there may be a multiplied focus on performance optimization and efficiency within the Application Server market. Organizations are searching out Application Servers that could manage high traffic volumes, offer low latency, and optimize aid usage. Application Servers that contain overall performance tracking and optimization features, which include caching, load balancing, and request optimization, are in excessive demand. This trend is pushed by means of the growing complexity and demand for high-acting programs. Moreover, safety is a vital subject in the Application Server market. As programs emerge as extra interconnected and cope with touchy information, corporations are seeking out Application Servers that offer robust safety features. Furthermore, the Application Server market is witnessing extended integration with emerging technologies consisting of artificial intelligence (AI) and machine learning (ML). Application Servers that include AI and ML abilities permit companies to construct wise applications that can examine facts, research from patterns, and make knowledgeable choices. Lastly, there's a shift in the direction of open-source Application Server solutions. Open-source Application Servers offer flexibility, customization alternatives, and price financial savings as compared to proprietary answers. They additionally benefit from a colorful community of developers and individuals, ensuring continuous development and innovation.

Leave a Comment