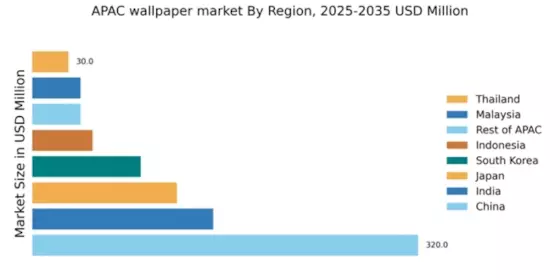

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 320.0 million, representing a significant portion of the APAC wallpaper market. Key growth drivers include rapid urbanization, rising disposable incomes, and a growing preference for aesthetic home decor. The government has implemented favorable policies to boost the construction sector, which in turn fuels wallpaper demand. Infrastructure development, particularly in tier-1 and tier-2 cities, is enhancing distribution channels and accessibility for consumers.

India : Rapid Urbanization Fuels Demand

India's wallpaper market is valued at 150.0 million, driven by a burgeoning middle class and increasing urbanization. The demand for wallpapers is rising as consumers seek innovative and stylish home decor solutions. Government initiatives promoting 'Make in India' are encouraging local manufacturing, while regulatory policies are easing import restrictions on raw materials. This environment fosters a competitive landscape for both domestic and international players.

Japan : Cultural Heritage Drives Innovation

Japan's wallpaper market, valued at 120.0 million, is characterized by a blend of traditional designs and modern aesthetics. The growth is driven by a strong cultural appreciation for interior design and home aesthetics. Regulatory policies support sustainable materials, aligning with consumer preferences for eco-friendly products. The market is also influenced by technological advancements in printing techniques, enhancing design capabilities.

South Korea : Design-Driven Consumer Preferences

South Korea's wallpaper market is valued at 90.0 million, with a strong focus on design and innovation. The demand is driven by a youthful population that values aesthetics in home decor. Government initiatives promoting smart homes and sustainable living are influencing consumer choices. The competitive landscape features both local and international brands, with a growing trend towards customization and personalization in wallpaper designs.

Malaysia : Cultural Fusion in Home Decor

Malaysia's wallpaper market, valued at 40.0 million, is experiencing growth due to increasing urbanization and a diverse consumer base. The demand for wallpapers is fueled by a blend of cultural influences, leading to unique design preferences. Government policies supporting the construction sector are enhancing market accessibility. The competitive landscape includes both local artisans and international brands, catering to various consumer tastes.

Thailand : Vibrant Market with Unique Trends

Thailand's wallpaper market is valued at 30.0 million, characterized by vibrant designs and a growing interest in home aesthetics. The market is driven by rising disposable incomes and a shift towards modern interior decor. Government initiatives promoting tourism and hospitality are boosting demand in commercial sectors. The competitive landscape features both local and international players, with a focus on eco-friendly materials and innovative designs.

Indonesia : Cultural Richness Influences Designs

Indonesia's wallpaper market, valued at 50.0 million, is expanding rapidly due to urbanization and a growing middle class. The demand for wallpapers is influenced by the country's rich cultural heritage, leading to unique design preferences. Government policies supporting infrastructure development are enhancing market accessibility. The competitive landscape includes both local manufacturers and international brands, focusing on customization and sustainability.

Rest of APAC : Unique Trends Across Sub-Regions

The Rest of APAC wallpaper market, valued at 40.0 million, showcases diverse consumer preferences influenced by local cultures. Growth is driven by increasing urbanization and a rising interest in home decor. Regulatory policies vary across countries, impacting market dynamics. The competitive landscape features a mix of local and international players, each catering to specific regional tastes and trends.