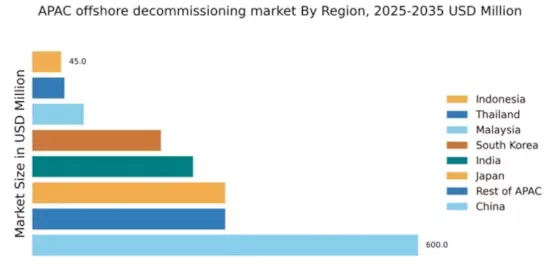

China : Strong Growth Driven by Regulations

China holds a commanding market share of 40% in the APAC offshore decommissioning sector, valued at $600.0 million. Key growth drivers include stringent environmental regulations and a push for sustainable energy practices. The demand for decommissioning services is rising due to aging offshore infrastructure and increased government initiatives aimed at environmental protection. Infrastructure development, particularly in coastal cities like Shanghai and Shenzhen, further supports this growth.

India : Regulatory Support Fuels Growth

India's offshore decommissioning market is valued at $250.0 million, accounting for 16.7% of the APAC market. The growth is driven by increasing offshore oil and gas activities and supportive government policies aimed at enhancing energy security. Demand is expected to rise as older platforms require decommissioning, particularly in states like Gujarat and Maharashtra. The Indian government is also promoting local content in decommissioning projects, which is expected to boost domestic capabilities.

Japan : Innovative Solutions for Aging Assets

Japan's offshore decommissioning market is valued at $300.0 million, representing 20% of the APAC market. The sector is driven by technological advancements and a focus on safety and environmental standards. Demand is increasing as older platforms in regions like Hokkaido and Kyushu reach the end of their operational life. The Japanese government is actively promoting research and development in decommissioning technologies, which is expected to enhance efficiency and reduce costs.

South Korea : Government Initiatives Boost Market

South Korea's offshore decommissioning market is valued at $200.0 million, making up 13.3% of the APAC market. Key growth drivers include government initiatives aimed at enhancing energy sustainability and the need to decommission aging offshore facilities. Major cities like Busan and Ulsan are pivotal in this sector, with local companies increasingly collaborating with international players. The competitive landscape features significant presence from firms like Samsung Heavy Industries and Daewoo Shipbuilding.

Malaysia : Strategic Location for Offshore Activities

Malaysia's offshore decommissioning market is valued at $80.0 million, accounting for 5.3% of the APAC market. The growth is driven by the country's strategic location and increasing offshore oil and gas activities. Demand is particularly strong in regions like Sarawak and Sabah, where aging platforms require decommissioning. The Malaysian government is also encouraging foreign investment in decommissioning services, enhancing the competitive landscape with international players entering the market.

Thailand : Regulatory Framework Supports Growth

Thailand's offshore decommissioning market is valued at $50.0 million, representing 3.3% of the APAC market. The growth is supported by a favorable regulatory framework and increasing offshore oil and gas exploration activities. Key regions include the Gulf of Thailand, where older platforms are being decommissioned. Local companies are collaborating with international firms to enhance service offerings, creating a competitive environment that fosters innovation and efficiency.

Indonesia : Focus on Environmental Sustainability

Indonesia's offshore decommissioning market is valued at $45.0 million, making up 3% of the APAC market. The sector is growing due to increasing environmental awareness and the need to decommission aging platforms in regions like Sumatra and Java. The Indonesian government is implementing policies to promote sustainable practices in decommissioning, which is attracting foreign investment. Local players are also enhancing their capabilities to meet international standards.

Rest of APAC : Varied Market Dynamics Across Regions

The Rest of APAC offshore decommissioning market is valued at $300.0 million, accounting for 20% of the overall APAC market. This segment includes various countries with unique regulatory environments and market dynamics. Demand is driven by aging offshore infrastructure and increasing environmental regulations. Countries like Vietnam and the Philippines are emerging markets, with local players beginning to establish a foothold in the decommissioning sector, creating diverse opportunities for growth.