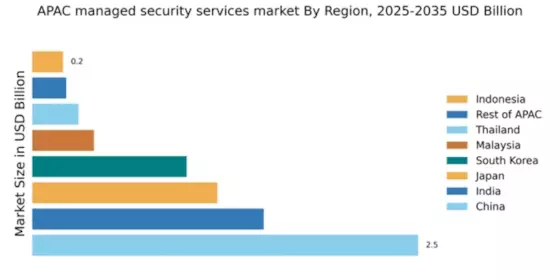

China : Robust Growth Driven by Innovation

China holds a commanding market share of 2.5 in the managed security services sector, driven by rapid digital transformation and increasing cyber threats. The government's push for cybersecurity regulations and initiatives, such as the Cybersecurity Law, has spurred demand for advanced security solutions. Additionally, the rise of e-commerce and cloud computing has led to heightened consumption patterns, necessitating robust security frameworks to protect sensitive data.

India : Rapid Digitalization Fuels Demand

India's managed security services market is valued at 1.5, reflecting a growing awareness of cybersecurity threats among businesses. Key growth drivers include the increasing adoption of cloud services and mobile technologies, alongside government initiatives like Digital India, which promote secure digital infrastructure. The demand for managed services is also influenced by rising cyberattacks, pushing organizations to invest in comprehensive security solutions.

Japan : Strong Focus on Cyber Resilience

Japan's market share stands at 1.2, characterized by a strong emphasis on technological innovation and cybersecurity resilience. The government has implemented policies to enhance national cybersecurity, including the Cybersecurity Strategy, which encourages collaboration between public and private sectors. The demand for managed security services is driven by the increasing sophistication of cyber threats and the need for compliance with stringent regulations.

South Korea : Government Support and Innovation

South Korea's managed security services market is valued at 1.0, supported by a robust IT infrastructure and government initiatives aimed at enhancing cybersecurity. The country has established the Cybersecurity Strategy 2020, which focuses on strengthening national security and promoting cybersecurity innovation. The demand for managed services is growing, particularly in sectors like finance and healthcare, where data protection is critical.

Malaysia : Investment in Cybersecurity Infrastructure

Malaysia's market share is 0.4, reflecting a burgeoning interest in managed security services driven by increasing cyber threats. The government has launched initiatives like the National Cyber Security Policy to bolster the country's cybersecurity posture. The demand for managed services is particularly strong in urban centers like Kuala Lumpur, where businesses are increasingly aware of the need for comprehensive security solutions.

Thailand : Focus on Regulatory Compliance

Thailand's managed security services market is valued at 0.3, with growth fueled by rising cyber threats and regulatory compliance requirements. The government has introduced the Cybersecurity Act to enhance national security and protect critical infrastructure. Demand for managed services is growing, particularly in sectors such as finance and telecommunications, where data security is paramount.

Indonesia : Increasing Awareness of Cyber Threats

Indonesia's market share is 0.2, reflecting a nascent but growing interest in managed security services. The rise in cyber incidents has prompted businesses to seek robust security solutions. Government initiatives, such as the National Cybersecurity Strategy, aim to enhance the country's cybersecurity framework. The demand for managed services is particularly evident in Jakarta, where digital transformation is accelerating.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC market share is 0.22, encompassing a diverse range of countries with varying cybersecurity needs. Growth is driven by increasing digitalization and the need for compliance with international standards. Each country faces unique challenges, from regulatory hurdles to varying levels of cybersecurity maturity. The competitive landscape includes both local and international players, adapting to the specific needs of each market.