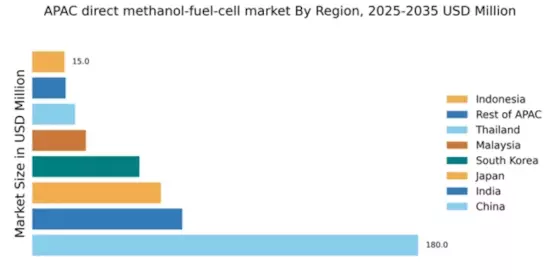

China : China's Dominance in Fuel Cells

China holds a commanding market share of 180.0, representing a significant portion of the APAC direct methanol fuel cell market. Key growth drivers include government initiatives promoting clean energy, substantial investments in infrastructure, and increasing demand for portable power solutions. The Chinese government has implemented favorable regulatory policies, including subsidies for fuel cell technology, which have spurred industrial development and innovation in this sector.

India : India's Growing Fuel Cell Landscape

India's market share stands at 70.0, driven by rising energy demands and government support for renewable energy initiatives. The Make in India campaign encourages local manufacturing of fuel cells, while urbanization and industrial growth are increasing consumption patterns. Regulatory frameworks are evolving to support clean energy technologies, enhancing the market's attractiveness for investors and manufacturers.

Japan : Japan's Advanced Fuel Cell Solutions

Japan, with a market share of 60.0, is recognized for its technological advancements in fuel cell systems. The government has set ambitious targets for hydrogen and fuel cell adoption, supported by policies that incentivize research and development. Demand is driven by applications in transportation and stationary power generation, reflecting a shift towards sustainable energy solutions in urban areas.

South Korea : South Korea's Fuel Cell Growth

South Korea's market share of 50.0 is bolstered by robust industrial applications and government backing for fuel cell technology. The country has established a comprehensive roadmap for hydrogen energy, promoting fuel cells in public transportation and residential sectors. The competitive landscape features major players like Doosan Fuel Cell, which are pivotal in driving innovation and market expansion.

Malaysia : Malaysia's Fuel Cell Initiatives

Malaysia's market share of 25.0 reflects its strategic initiatives to promote clean energy solutions. The government is actively supporting research and development in fuel cell technology, aligning with its commitment to sustainable energy. Demand is growing in sectors such as transportation and backup power systems, driven by urbanization and industrialization efforts across key cities like Kuala Lumpur.

Thailand : Thailand's Fuel Cell Potential

Thailand holds a market share of 20.0, with increasing interest in fuel cell technology driven by government policies aimed at reducing carbon emissions. The country is focusing on developing infrastructure for clean energy, particularly in urban areas. Key applications include transportation and energy storage, with local players beginning to emerge in the competitive landscape.

Indonesia : Indonesia's Fuel Cell Market Growth

Indonesia's market share of 15.0 is characterized by a growing demand for clean energy solutions amid rising energy consumption. The government is exploring fuel cell technology as part of its renewable energy strategy, with initiatives aimed at enhancing energy access in remote areas. The competitive landscape is still developing, with opportunities for international players to enter the market.

Rest of APAC : Emerging Trends in APAC

The Rest of APAC holds a market share of 15.6, showcasing diverse market dynamics across various countries. Growth is driven by increasing awareness of clean energy solutions and supportive government policies. Countries in this category are beginning to adopt fuel cell technology in sectors like transportation and industrial applications, creating opportunities for market players to expand their reach.