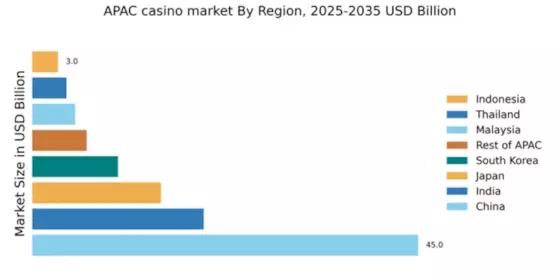

China : Unmatched Market Share and Potential

Key markets include Macau, which is the world's largest gaming destination, and cities like Beijing and Shanghai, which are seeing a rise in domestic gaming. The competitive landscape features major players like Galaxy Entertainment Group and SJM Holdings, who dominate the Macau market. Local dynamics are influenced by a mix of traditional gaming and modern entertainment options, catering to both domestic and international tourists. The sector is also seeing growth in online gaming applications, driven by technological advancements.

India : Rapid Growth and Regulatory Changes

Key markets include Goa, Sikkim, and Daman, where casinos are already operational. The competitive landscape features local players like Delta Corp and international entrants looking to capitalize on the growing market. The business environment is evolving, with states like Goa and Sikkim leading in regulatory frameworks. The sector is also seeing interest in online gaming, which is gaining traction among younger demographics.

Japan : Integration of Entertainment and Gaming

Key markets include Tokyo and Osaka, which are poised to host major integrated resorts. The competitive landscape is still developing, with international players like MGM Resorts and Wynn Resorts eyeing entry. Local dynamics are characterized by a cautious approach to gambling, with a focus on creating family-friendly entertainment environments. The sector is expected to integrate various industries, including hospitality and retail, enhancing overall visitor experience.

South Korea : Focus on Foreign Tourists and Gaming

Key markets include Seoul and Jeju Island, where several casinos cater primarily to foreign visitors. The competitive landscape features major players like Paradise Co. and Kangwon Land, which are well-established in the market. Local dynamics are influenced by cultural attitudes towards gambling, with a focus on luxury experiences. The sector is also exploring online gaming options to diversify offerings and attract a broader audience.

Malaysia : Strategic Location and Tourism Focus

Key markets include Kuala Lumpur and Genting Highlands, which attract both local and international visitors. The competitive landscape features prominent players like Genting Group, which dominates the market. Local dynamics are characterized by a blend of traditional gaming and modern entertainment options, catering to diverse consumer preferences. The sector is also seeing growth in online gaming, appealing to younger audiences.

Thailand : Tourism-Driven Market Opportunities

Key markets include Bangkok and Pattaya, which are popular tourist destinations. The competitive landscape is currently limited due to regulatory constraints, but local players are advocating for legalization. The business environment is evolving, with increasing interest from international operators. The sector could benefit from integrating gaming with Thailand's rich cultural and entertainment offerings.

Indonesia : Regulatory Challenges and Opportunities

Key markets include Bali and Jakarta, where tourism is a major economic contributor. The competitive landscape is currently limited due to regulatory barriers, but there is interest from international operators looking to enter the market. Local dynamics are influenced by cultural attitudes towards gambling, with a focus on responsible gaming. The sector could see growth in online gaming as regulations evolve.

Rest of APAC : Varied Regulations and Opportunities

Key markets include emerging destinations like Vietnam and the Philippines, where casinos are becoming more popular. The competitive landscape features a mix of local and international players, with significant investments in integrated resorts. Local dynamics vary widely, with some countries embracing gaming as a tourism driver while others maintain strict regulations. The sector is also seeing growth in online gaming, appealing to a broader audience.