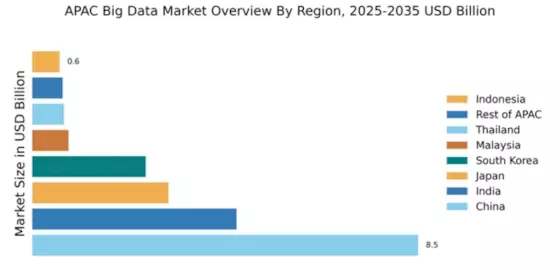

China : Unmatched Growth and Innovation

Key markets include Beijing, Shanghai, and Shenzhen, which are hubs for technology and innovation. The competitive landscape features major players like Alibaba, Tencent, and Huawei, alongside global giants such as IBM and Microsoft. The local business environment is characterized by a strong emphasis on R&D and collaboration between tech firms and government entities. Industries such as finance, healthcare, and manufacturing are leveraging big data for predictive analytics and operational efficiency, driving further market growth.

India : Innovation and Investment Surge

Key markets include Bengaluru, Hyderabad, and Mumbai, which are recognized as technology hubs. The competitive landscape is vibrant, with local players like Zomato and Flipkart alongside global firms such as Amazon and Google. The business environment is conducive to innovation, with a focus on sectors like e-commerce, fintech, and healthcare, where big data applications are transforming operations and customer engagement.

Japan : Strong Focus on AI Integration

Key markets include Tokyo, Osaka, and Nagoya, which are centers for technology and manufacturing. The competitive landscape features major players like Fujitsu, NEC, and Hitachi, alongside international firms like Oracle and SAP. The local market dynamics are characterized by a strong focus on R&D and collaboration between academia and industry, particularly in sectors like automotive, healthcare, and finance, where big data is enhancing operational efficiency and customer insights.

South Korea : Strong Government Support and Innovation

Key markets include Seoul, Busan, and Incheon, which are at the forefront of technological innovation. The competitive landscape features local giants like Samsung and LG, alongside global players such as IBM and Microsoft. The business environment is dynamic, with a focus on sectors like e-commerce, healthcare, and manufacturing, where big data applications are driving efficiency and enhancing customer experiences.

Malaysia : Investment in Digital Infrastructure

Key markets include Kuala Lumpur and Penang, which are hubs for technology and innovation. The competitive landscape features local players like Axiata and Maxis, alongside international firms such as Microsoft and Oracle. The local business environment is supportive of innovation, with a focus on sectors like finance, healthcare, and logistics, where big data applications are enhancing operational efficiency and customer engagement.

Thailand : Focus on Digital Transformation

Key markets include Bangkok and Chiang Mai, which are centers for technology and innovation. The competitive landscape features local players like True Corporation and AIS, alongside global firms such as IBM and SAP. The business environment is dynamic, with a focus on sectors like tourism, retail, and healthcare, where big data applications are driving efficiency and enhancing customer experiences.

Indonesia : Investment in Digital Solutions

Key markets include Jakarta and Surabaya, which are at the forefront of technological innovation. The competitive landscape features local players like Gojek and Tokopedia, alongside international firms such as Google and Amazon. The local business environment is characterized by a focus on sectors like e-commerce, finance, and logistics, where big data applications are transforming operations and customer engagement.

Rest of APAC : Varied Growth Across Regions

Key markets include various countries such as Vietnam, Philippines, and Singapore, each with unique market dynamics. The competitive landscape features a mix of local and international players, with a focus on sectors like agriculture, manufacturing, and finance, where big data applications are enhancing operational efficiency and customer insights.