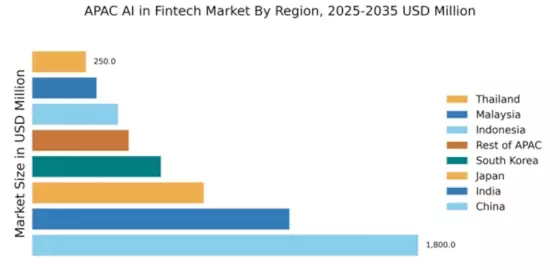

China : Unmatched Growth and Innovation

China holds a commanding market share of 40% in the APAC AI fintech sector, valued at $1800.0 million. Key growth drivers include rapid digitalization, a tech-savvy population, and government support for fintech innovation. Demand for AI-driven solutions is surging, particularly in mobile payments and wealth management. Regulatory policies are increasingly favorable, with initiatives aimed at fostering innovation while ensuring consumer protection. Infrastructure development, especially in urban centers, is robust, facilitating fintech growth.

India : Innovation Meets Regulation

India's AI fintech market is valued at $1200.0 million, capturing 25% of the APAC share. The growth is driven by increasing smartphone penetration, a young demographic, and supportive government initiatives like Digital India. Demand for digital payment solutions and lending platforms is on the rise, supported by favorable regulatory frameworks. The government is actively promoting financial inclusion, which is further enhancing consumption patterns in the fintech space.

Japan : Mature Market with Unique Needs

Japan's AI fintech market is valued at $800.0 million, representing 17% of the APAC market. Key growth drivers include an aging population seeking efficient financial solutions and a strong emphasis on security and compliance. Demand for AI in customer service and fraud detection is increasing, supported by regulatory bodies that prioritize consumer protection. The government is also investing in digital infrastructure to enhance fintech capabilities.

South Korea : A Hub for Fintech Startups

South Korea's AI fintech market is valued at $600.0 million, accounting for 13% of the APAC share. The growth is fueled by high internet penetration and a culture of innovation. Demand for AI applications in trading and investment management is rising, with government initiatives promoting fintech startups. The competitive landscape is vibrant, with major players like Kakao and Naver leading the charge in digital finance solutions.

Malaysia : Growth Amidst Regulatory Support

Malaysia's AI fintech market is valued at $300.0 million, capturing 6% of the APAC market. The growth is driven by government initiatives like the Financial Technology Regulatory Sandbox, which encourages innovation. Demand for digital banking and payment solutions is increasing, supported by a young, tech-savvy population. The competitive landscape includes local players and international firms, creating a dynamic business environment.

Thailand : Government Support Fuels Innovation

Thailand's AI fintech market is valued at $250.0 million, representing 5% of the APAC share. Key growth drivers include government initiatives aimed at enhancing financial inclusion and digital literacy. Demand for mobile payment solutions is surging, supported by a growing e-commerce sector. The competitive landscape features both local startups and established players, creating a diverse market environment.

Indonesia : Youth-Driven Market Dynamics

Indonesia's AI fintech market is valued at $400.0 million, accounting for 8% of the APAC market. The growth is driven by a large, young population increasingly adopting digital financial services. Demand for peer-to-peer lending and mobile payments is on the rise, supported by government initiatives promoting financial inclusion. The competitive landscape is vibrant, with numerous startups and established players vying for market share.

Rest of APAC : Varied Markets, Unique Challenges

The Rest of APAC's AI fintech market is valued at $450.0 million, capturing 9% of the overall market. Growth is driven by varying levels of digital adoption and regulatory environments across countries. Demand for localized fintech solutions is increasing, with governments in these regions promoting innovation. The competitive landscape is diverse, featuring both local and international players, each adapting to unique market conditions.