Top Industry Leaders in the Anti Static Films Market

Anti Static Films Market

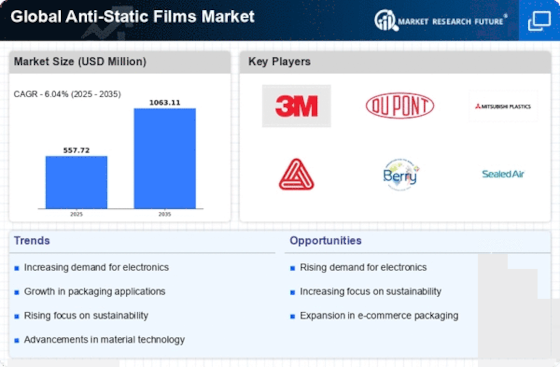

The anti-static films market is a dynamic space buzzing with competition from established players and innovative newcomers. The market's growth trajectory is fueled by the burgeoning electronics and automotive industries, alongside rising demand for static-sensitive components and equipment. To navigate this competitive landscape, understanding the strategies employed by key players, the factors influencing market share, and recent industry developments is crucial.

Strategies for a Sticky Edge:

-

Product Innovation: Leading players like Achilles Corporation, Toyobo Co. Ltd., and 3M are constantly pushing boundaries, developing anti-static films with enhanced functionalities like scratch resistance, anti-fogging, and even self-healing properties. -

Diversification: Capturing a broader market share often involves venturing beyond core product lines. Mitsubishi Polymer Film Inc., for instance, capitalized on the pandemic by producing anti-fog films for medical face shields, showcasing their adaptability. -

Strategic Partnerships and Acquisitions: Collaborations with other companies in the supply chain or acquiring smaller players with niche expertise can strengthen market reach and access new technologies. -

Focus on Sustainability: With growing environmental consciousness, companies are developing biodegradable anti-static films using recycled materials, catering to a burgeoning eco-conscious consumer base. -

Regional Expansion: Tapping into the burgeoning demand in regions like Asia-Pacific with its large manufacturing base and rising disposable income is a key strategy for global players.

Factors Dictating the Market Share Dominoes:

-

Product Portfolio and Quality: Offering a diverse range of films tailored to specific applications and industries, coupled with consistent quality control, ensures customer loyalty and market leadership. -

Manufacturing Efficiency and Cost Competitiveness: Optimizing production processes and controlling costs can lead to a competitive edge, especially in price-sensitive markets. -

Brand Recognition and Reputation: Established brands with a strong track record of reliability and innovation often enjoy a loyal customer base and market trust. -

Distribution Network and Customer Service: Robust distribution channels and responsive customer service contribute significantly to market penetration and customer satisfaction. -

Compliance with Regulations: Stringent regulations in certain industries like electronics and medical devices necessitate adherence to specific standards, which can be a barrier to entry for smaller players.

Key Companies in the Anti-Static Films Market include

Toyobo Co Ltd

Nan Ya Plastics Corp,

Toray Plastics (America) Inc.

Achilles Corp.

Pentaplast Europe GmbH & Co KG

RTP Company

Kolon Industries Inc

Saint-Gobain Corp

Unitika Corp.

Dunmore Inc.

Recent Developments:

-

August 2023: Lintec introduces a new bio-based anti-static film for electronics packaging, aligning with sustainability goals and customer demand for eco-friendly solutions. -

September 2023: Toray expands its Lumina™ film production capacity in Japan to meet the growing demand for high-performance anti-static films in the electronics industry. -

October 2023: DuPont Teijin Films unveils a new Kapton® film grade with improved printability for automotive applications, catering to the need for customized and visually appealing components. -

November 2023: 3M expands its distribution network in China through partnerships with local distributors, aiming to reach a wider customer base in the emerging market.