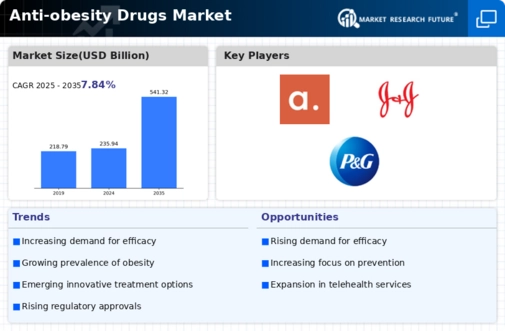

Rising Obesity Rates

The increasing prevalence of obesity is a primary driver for the Anti-obesity Drugs Market. According to recent data, approximately 39% of adults are classified as overweight, with 13% being obese. This alarming trend is prompting healthcare systems to seek effective pharmacological interventions. The rising obesity rates are not only a health concern but also a significant economic burden, leading to increased healthcare costs and loss of productivity. As a result, there is a growing demand for anti-obesity medications that can assist in weight management and reduce obesity-related comorbidities. The Anti-obesity Drugs Market is thus positioned to expand as more individuals seek medical solutions to combat obesity.

Advancements in Drug Development

Innovations in drug development are significantly influencing the Anti-obesity Drugs Market. Recent advancements have led to the emergence of novel pharmacological agents that target specific pathways involved in appetite regulation and energy expenditure. For instance, medications that utilize mechanisms such as GLP-1 receptor agonism have shown promising results in clinical trials, leading to increased efficacy and safety profiles. The introduction of these new drugs is expected to enhance treatment options for patients struggling with obesity, thereby expanding the market. As research continues to evolve, the Anti-obesity Drugs Market may witness a surge in new product launches, catering to diverse patient needs and preferences.

Regulatory Support and Approvals

Regulatory support plays a crucial role in shaping the Anti-obesity Drugs Market. Recent years have seen an increase in the approval of anti-obesity medications by regulatory bodies, which has encouraged pharmaceutical companies to invest in research and development. The streamlined approval processes for new drugs, coupled with incentives for developing obesity treatments, have fostered a more favorable environment for innovation. As more drugs receive regulatory approval, the market is likely to expand, providing patients with a wider array of treatment options. This regulatory landscape is essential for the growth of the Anti-obesity Drugs Market, as it directly impacts the availability and accessibility of effective medications.

Increased Awareness of Health Risks

There is a growing awareness of the health risks associated with obesity, which is driving the Anti-obesity Drugs Market. Public health campaigns and educational initiatives have highlighted the link between obesity and various chronic diseases, such as diabetes, cardiovascular diseases, and certain cancers. This heightened awareness is leading individuals to seek medical advice and treatment options, including anti-obesity drugs. Furthermore, healthcare providers are increasingly recommending pharmacotherapy as part of a comprehensive weight management plan. The Anti-obesity Drugs Market is likely to benefit from this trend, as more patients become informed about the potential health benefits of weight loss and the role of medications in achieving their goals.

Integration of Lifestyle Interventions

The integration of lifestyle interventions with pharmacotherapy is emerging as a key driver for the Anti-obesity Drugs Market. Healthcare professionals are increasingly recognizing that combining anti-obesity drugs with lifestyle modifications, such as diet and exercise, can lead to more sustainable weight loss outcomes. This holistic approach not only enhances the effectiveness of medications but also improves patient adherence to treatment plans. As healthcare systems adopt this integrated model, the demand for anti-obesity drugs is expected to rise. The Anti-obesity Drugs Market stands to benefit from this trend, as patients seek comprehensive solutions that address both pharmacological and behavioral aspects of weight management.