Technological Advancements

The Anime Market is experiencing a notable transformation due to rapid technological advancements. Innovations in animation software and production techniques have enhanced the quality and efficiency of anime creation. For instance, the integration of artificial intelligence in animation processes has streamlined workflows, allowing studios to produce content at a faster pace. This technological evolution not only improves the visual appeal of anime but also reduces production costs, making it more accessible for creators. Furthermore, the rise of virtual reality and augmented reality technologies presents new avenues for immersive storytelling, potentially attracting a broader audience. As a result, the Anime Market is likely to witness increased investment in technology-driven projects, fostering creativity and expanding its reach.

Diverse Audience Demographics

The Anime Market is increasingly appealing to a diverse range of audience demographics. Traditionally, anime was primarily targeted at younger viewers; however, recent trends indicate a growing interest among older audiences, including adults and families. This shift is evidenced by the rise of anime genres that cater to various age groups, such as slice-of-life, romance, and psychological thrillers. Additionally, the increasing availability of dubbed and subtitled content has made anime more accessible to non-Japanese speakers, further broadening its audience base. According to recent data, the percentage of adult viewers has risen significantly, suggesting that the Anime Market is evolving to meet the preferences of a more varied demographic. This diversification may lead to increased revenue streams and opportunities for content creators.

Cultural Exchange and Influence

The Anime Market is significantly influenced by cultural exchange and globalization. As anime continues to gain popularity outside of Japan, it serves as a medium for cultural exchange, introducing international audiences to Japanese traditions, values, and storytelling techniques. This cultural influence is evident in the growing number of collaborations between Japanese studios and international creators, resulting in unique hybrid projects that appeal to a wider audience. Moreover, the increasing presence of anime conventions and festivals worldwide fosters community engagement and promotes cultural appreciation. The Anime Market is likely to benefit from this trend, as it encourages cross-cultural dialogue and enhances the global appeal of anime, potentially leading to increased viewership and merchandise sales.

Expansion of Merchandise Opportunities

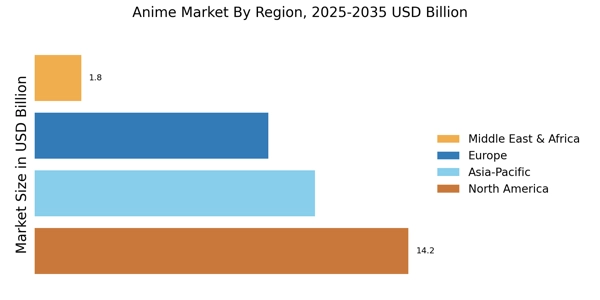

The Anime Market is witnessing a substantial expansion in merchandise opportunities, driven by the growing popularity of anime series and characters. Merchandise, including figurines, apparel, and collectibles, has become a significant revenue stream for studios and creators. Recent statistics indicate that The Anime Market is projected to reach substantial figures, reflecting the increasing consumer demand for anime-related products. This trend is further fueled by the rise of social media platforms, where fans actively share their collections and engage with brands. As a result, the Anime Market is likely to see a surge in collaborations with retailers and brands, creating innovative merchandise that resonates with fans. This expansion not only enhances brand loyalty but also contributes to the overall growth of the anime ecosystem.

Rise of International Streaming Platforms

The Anime Market is experiencing a transformative phase with the rise of international streaming platforms. Services such as Netflix, Crunchyroll, and Funimation have significantly increased the accessibility of anime content to audiences worldwide. This trend has led to a surge in viewership, as these platforms offer a vast library of titles, including both classic and contemporary series. Recent data suggests that subscription numbers for these platforms have grown exponentially, indicating a robust demand for anime content. Furthermore, the strategic partnerships between streaming services and anime studios facilitate the production of exclusive content, enhancing the appeal of these platforms. As a result, the Anime Market is likely to continue evolving, with streaming services playing a pivotal role in shaping viewing habits and expanding the reach of anime.