Rising Demand for Animal Protein

The Global Animal Genetics Market Industry is experiencing a surge in demand for animal protein, driven by increasing global populations and changing dietary preferences. As consumers shift towards protein-rich diets, the need for genetically improved livestock becomes paramount. This trend is particularly evident in developing regions where meat consumption is on the rise. The market is projected to reach 4 USD Billion in 2024, reflecting the growing emphasis on sustainable and efficient animal production systems. Genetic advancements enable farmers to enhance productivity, improve feed efficiency, and reduce environmental impacts, thereby aligning with consumer expectations for quality and sustainability.

Emerging Markets and Globalization

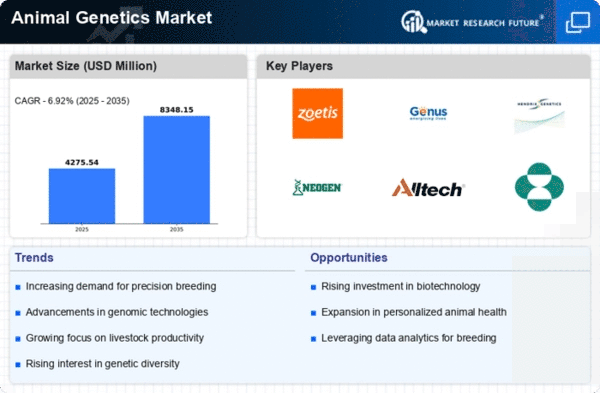

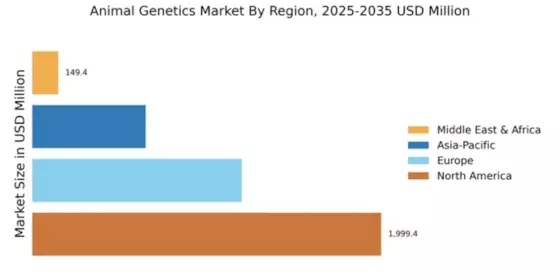

Emerging markets are becoming increasingly influential in the Global Animal Genetics Market Industry. Countries in Asia, Africa, and Latin America are witnessing rapid economic growth, leading to rising disposable incomes and changing consumption patterns. This trend is driving demand for high-quality animal products, necessitating the adoption of advanced genetic technologies. Globalization further facilitates the exchange of genetic materials and knowledge, enabling farmers to access superior breeding stock. As these markets expand, they present significant opportunities for growth, with the potential for the market to reach 8.35 USD Billion by 2035, reflecting the interconnectedness of global agricultural systems.

Government Initiatives and Support

Government initiatives and support play a crucial role in the Global Animal Genetics Market Industry. Many countries are implementing policies that promote research and development in animal genetics, recognizing its significance for food security and agricultural sustainability. Funding for genetic research, subsidies for farmers adopting advanced breeding technologies, and educational programs are examples of government efforts to enhance the sector. These initiatives not only stimulate innovation but also encourage collaboration between public and private sectors. As a result, the market is likely to benefit from increased investment and a more robust infrastructure, facilitating growth and development in the coming years.

Increasing Focus on Animal Welfare

The Global Animal Genetics Market Industry is increasingly influenced by a heightened focus on animal welfare. Consumers are becoming more aware of the ethical implications of animal husbandry, prompting producers to adopt practices that ensure humane treatment. Genetic selection for traits that enhance animal well-being, such as stress resilience and improved health, is gaining traction. This shift not only meets consumer demands but also aligns with regulatory frameworks aimed at promoting ethical farming practices. As a result, the market is expected to expand, with projections indicating a potential growth to 8.35 USD Billion by 2035, reflecting the importance of welfare in breeding programs.

Market Trends and Growth Projections

The Global Animal Genetics Market Industry is characterized by dynamic trends and growth projections. The market is expected to reach 4 USD Billion in 2024, with a robust CAGR of 6.92% anticipated from 2025 to 2035. Key trends include the adoption of precision breeding techniques, increased investment in genetic research, and a growing emphasis on sustainability. These factors collectively contribute to the market's expansion, as stakeholders recognize the importance of genetic advancements in addressing global food security challenges. The interplay of these trends is likely to shape the future landscape of the animal genetics sector, fostering innovation and collaboration.

Technological Advancements in Genetic Engineering

Technological innovations in genetic engineering are reshaping the Global Animal Genetics Market Industry. Techniques such as CRISPR and genomic selection are enabling more precise breeding methods, leading to healthier and more productive animals. These advancements not only enhance disease resistance but also improve growth rates and reproductive performance. As a result, the market is poised for significant growth, with a projected CAGR of 6.92% from 2025 to 2035. The integration of these technologies is likely to attract investments and foster collaborations among stakeholders, further driving the evolution of animal genetics and ensuring food security.