Regulatory Incentives and Support

Regulatory incentives and support play a crucial role in shaping the Ancillary Services for Battery Energy Storage Systems Market. Governments worldwide are increasingly implementing policies that promote the adoption of energy storage technologies. These policies often include financial incentives, tax credits, and grants aimed at reducing the initial investment costs associated with battery energy storage systems. For instance, certain regions have established frameworks that allow energy storage systems to participate in ancillary service markets, thereby enhancing their economic viability. This regulatory support not only encourages investment in battery energy storage but also fosters innovation in ancillary services, ultimately contributing to a more resilient energy infrastructure.

Rising Awareness of Energy Efficiency

Rising awareness of energy efficiency among consumers and businesses is driving the Ancillary Services for Battery Energy Storage Systems Market. As stakeholders become more conscious of their energy consumption and its environmental impact, there is a growing inclination towards adopting energy-efficient technologies. Battery energy storage systems are recognized for their ability to optimize energy use, reduce costs, and provide ancillary services that enhance grid reliability. Market studies indicate that energy efficiency initiatives are expected to increase investments in battery storage solutions, as they align with sustainability goals. This heightened awareness is likely to propel the demand for ancillary services, as organizations seek to leverage battery energy storage systems for improved energy management.

Technological Innovations in Battery Systems

Technological innovations in battery systems are significantly influencing the Ancillary Services for Battery Energy Storage Systems Market. Advances in battery chemistry, such as the development of solid-state batteries and improvements in lithium-ion technology, are enhancing the performance and lifespan of energy storage systems. These innovations enable battery systems to provide ancillary services more efficiently, such as peak shaving and demand response. Market data indicates that the efficiency of battery systems has improved by approximately 30% over the past few years, making them more attractive for ancillary service applications. As technology continues to evolve, the capabilities of battery energy storage systems are expected to expand, further driving their adoption in ancillary services.

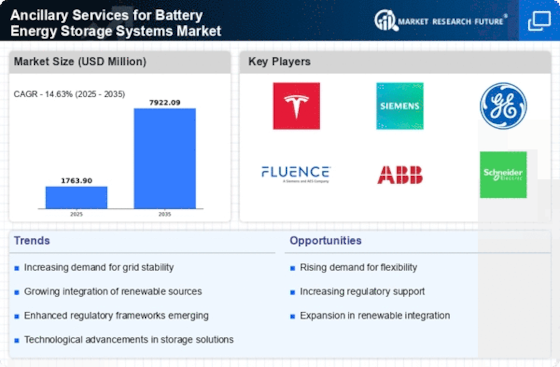

Increasing Demand for Energy Storage Solutions

The rising demand for energy storage solutions is a primary driver for the Ancillary Services for Battery Energy Storage Systems Market. As the need for reliable and efficient energy management escalates, battery energy storage systems are increasingly recognized for their ability to provide ancillary services such as frequency regulation and load balancing. According to recent data, the energy storage market is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is largely attributed to the integration of renewable energy sources, which necessitate robust storage solutions to ensure grid stability. Consequently, the ancillary services provided by battery energy storage systems are becoming indispensable for maintaining the reliability of power systems.

Growing Integration of Distributed Energy Resources

The growing integration of distributed energy resources (DERs) is a significant driver for the Ancillary Services for Battery Energy Storage Systems Market. As more consumers and businesses adopt solar panels, wind turbines, and other renewable technologies, the need for effective energy management solutions becomes paramount. Battery energy storage systems serve as a critical component in this integration, providing ancillary services that help balance supply and demand. The increasing penetration of DERs is projected to lead to a surge in demand for ancillary services, as these systems can mitigate the intermittency associated with renewable energy sources. This trend suggests a robust future for battery energy storage systems in supporting the stability of the energy grid.