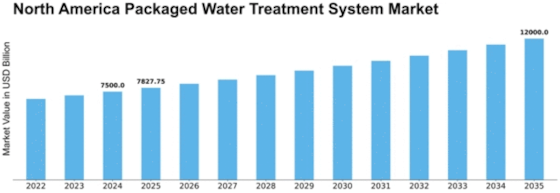

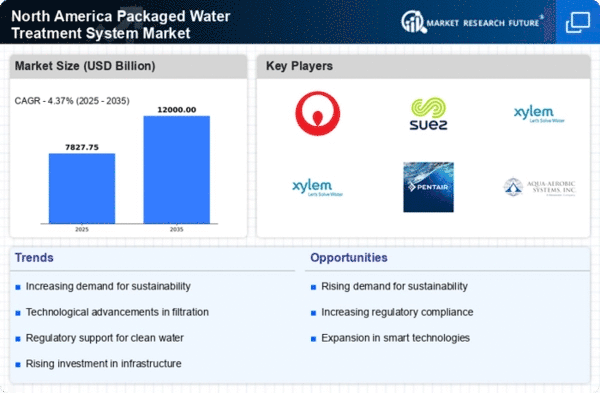

Americas Packaged Water Treatment System Size

Americas Packaged Water Treatment System Market Growth Projections and Opportunities

Packaged water treatment systems have emerged as integral components in the water management landscape, offering a streamlined and efficient solution to the challenges of water treatment. These systems, characterized by their pre-assembled, skid-mounted, and factory-tested design, represent a paradigm shift in water treatment methodology. Their unique attributes, including ease of installation, reduced on-site construction costs, and transportability, make them a compelling choice for a wide range of applications, particularly in residential complexes and industries.

The fundamental design of packaged water treatment systems revolves around the concept of pre-assembled units. Unlike traditional water treatment systems that often require complex on-site construction, packaged systems come ready for deployment. The components of these systems are meticulously assembled and tested in a controlled factory environment, ensuring a high level of quality control and performance consistency. This not only accelerates the implementation process but also minimizes the potential for on-site errors, leading to more reliable and efficient water treatment solutions.

One of the distinctive features of packaged water treatment systems is their skid-mounted configuration. The entire water treatment unit is mounted on a skid, providing mobility and ease of transport to the desired location. This mobility is particularly advantageous in situations where water treatment needs may vary or where temporary treatment facilities are required. Industries with dynamic operational requirements and remote locations benefit significantly from the portability of packaged systems, allowing for agile responses to changing water treatment demands.

The significance of packaged water treatment systems is amplified in their ability to store a substantial volume of water. These systems are designed to cater to varying water treatment capacities, making them suitable for both residential complexes and industrial applications. The storage capability ensures a consistent and reliable water supply, essential for meeting the demands of diverse settings. Whether deployed in a community setting or within an industrial facility, packaged water treatment systems contribute to the provision of safe and clean water.

Residential complexes stand to gain substantial advantages from the adoption of packaged water treatment systems. The compact design and ease of installation make them particularly well-suited for residential applications. Communities can benefit from the efficient removal of contaminants and pathogens from the water supply, enhancing the overall quality of drinking water. Moreover, the reduced on-site construction costs associated with packaged systems make them a cost-effective choice for residential developments.

In industrial settings, where water treatment is paramount for various processes, packaged systems offer a versatile and efficient solution. The mobility of these systems facilitates their integration into diverse industrial operations, allowing for strategic placement based on specific water treatment needs. Industries with changing water quality requirements or those operating in remote locations find packaged systems to be a flexible and reliable choice for ensuring the availability of high-quality water for their processes.

The adoption of packaged water treatment systems aligns with the growing emphasis on sustainability and resource optimization. These systems contribute to reduced on-site construction activities, minimizing environmental impact and disruption to local ecosystems. The efficient use of resources during the manufacturing process, coupled with the mobility and adaptability of packaged systems, positions them as environmentally conscious choices in the realm of water treatment.

Packaged water treatment systems represent a transformative approach to water management, offering a blend of efficiency, mobility, and environmental consciousness. The pre-assembled, skid-mounted, and factory-tested design addresses the complexities associated with traditional water treatment methods. Whether catering to the needs of residential complexes or diverse industrial applications, these systems provide a reliable and cost-effective solution. As the demand for sustainable and efficient water treatment practices continues to rise, packaged water treatment systems emerge as a key player in ensuring the availability of clean and safe water for various sectors.

Leave a Comment