Top Industry Leaders in the Americas Packaged Water Treatment System Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the industry are:

- GE Water & Process Technologies (U.S.)

- RWL Water (U.S.)

- WesTech Engineering Inc. (U.S.)

- Smith & Loveless Inc. (U.S.)

- Napier-Reid Ltd. (Canada)

- Enviroquip (U.S.)

- Corix Water System (Canada), and others.

Quenching the Thirst for Growth: Navigating the Americas Packaged Water Treatment System Market

The Americas packaged water treatment system market is a bubbling arena where established players battle for a refreshing share. Understanding the strategies driving this competition, the factors influencing market share, and emerging trends is crucial for success in this dynamic landscape.

Key Players and their Strategies:

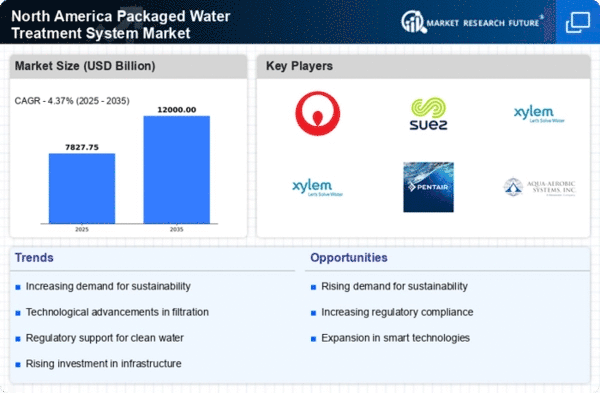

- Global Giants: Goliaths like Veolia Water Technologies and Suez Water Technologies & Solutions leverage their extensive product portfolios, global reach, and brand recognition to command a significant market share. Veolia offers diverse solutions across industries, while Suez excels in advanced technologies like reverse osmosis.

- Regional Champions: Companies like Pentair and Culligan International dominate specific geographies by tailoring solutions to regional water challenges and regulations. Pentair caters to diverse applications with its broad product range, while Culligan excels in customized solutions.

- Agile Innovators: Startups like Watts Water Technologies and Evoqua Water Technologies are disrupting the market with cutting-edge approaches. Watts focuses on smart filtration systems with remote monitoring capabilities, while Evoqua pushes the boundaries of membrane technology.

Factors for Market Share Analysis:

- Product Breadth and Depth: Offering a range of systems for diverse applications (municipal, industrial, commercial) and contaminant removal needs expands market reach and caters to varied customer segments.

- Technological Innovation: Integrating advanced features like smart controls, real-time performance monitoring, and self-cleaning capabilities enhances efficiency, minimizes maintenance costs, and attracts water-conscious customers. Watts' smart filtration systems exemplify this.

- Cost-Effectiveness and Return on Investment (ROI): Balancing advanced features with affordability is crucial, especially in budget-sensitive segments. Pentair's diverse product range caters to various budgets, while Culligan's customized solutions prioritize ROI.

- Sustainability Focus: Reducing water waste, minimizing energy consumption, and utilizing recyclable materials is gaining traction. Evoqua's focus on energy-efficient membranes exemplifies this commitment.

Emerging Trends and Company Strategies:

- Smart Systems and Data-Driven Insights: Integrating sensors, communication modules, and AI into systems enables real-time performance monitoring, predictive maintenance, and data-driven optimization. This trend resonates with companies like Watts and Evoqua.

- Decentralized Water Treatment: Offering compact, modular systems for on-site water treatment at point-of-use caters to growing demand for localized water quality control. Companies like Culligan are adapting their solutions to this trend.

- Focus on Specific Segments: Targeting high-growth segments like food & beverage industries, healthcare facilities, and remote communities with tailored systems is attracting attention. Pentair's food & beverage solutions exemplify this approach.

- Membrane Advancements: Developing next-generation membranes with improved efficiency, higher rejection rates, and longer lifespans is a growing focus. Evoqua's research in advanced membrane technology exemplifies this trend.

Overall Competitive Scenario:

The Americas packaged water treatment system market presents a dynamic landscape where global giants face challenges from regional players and technology-driven startups. Success hinges on offering diverse product portfolios, embracing technological advancements like smart features and decentralized solutions, prioritizing sustainability, and catering to specific market segments. Companies demonstrating agility, cost-effectiveness, and a commitment to innovative and responsible water treatment hold a strong hand in navigating this fiercely competitive and ever-evolving market.

Latest Company Updates:

November 2023- Singlet oxygen-generating treatment technology achieves sustainable operations and helps operators meet production goals. A new chemistry solution, first developed for the food and beverage industry, provides an environmentally safe and economical alternative for upstream water treatment without the hazards or cost of traditional oxidizers or conventional biocides. While water use has always been an issue, it was only in the late 1990s that unchecked water use in the oil field became a concern, with the industry competing with agriculture and cities for clean water supplies. Hydraulically fracturing shale formations brought the country energy independence, but it also highlighted the large amount of water needed to execute the process successfully. In the last decade, this was further exacerbated by investors wanting greener, more environmentally friendly companies to invest in. The perfect nexus of environmental stewardship, innovative technology, and good business practices brought scientists to think outside of the box while adapting technologies from other industries. Traditional water treatment.

Microbial control has always been a primary concern for completion water. Water sourced from traditional water storage facilities, such as pits and ponds, requires effective microbial control prior to introduction to the wellbore, as this is essential for a healthy formation. Choosing the wrong solution for water treatment can result in expensive damage to equipment, a high bacteria load pumped downhole, and a potentially sour well. Traditional oil and gas microbial treatment solutions can be divided into two types. One involves oxidizers that provide economical, fast bacteria control. However, many companies frown upon oxidizers since the most common of them is chlorine dioxide, a volatile, flammable gas that presents significant exposure hazards to well-site personnel and accelerates corrosion. The second type includes conventional biocides and preservatives, such as glutaraldehyde (glut), quaternary ammonium compounds (quat), glut-quat blends, and aldehyde-releasing compounds. These conventional chemistries provide a longer-lasting solution but are more expensive and slower-acting, and users cannot obtain immediate feedback on efficacy.