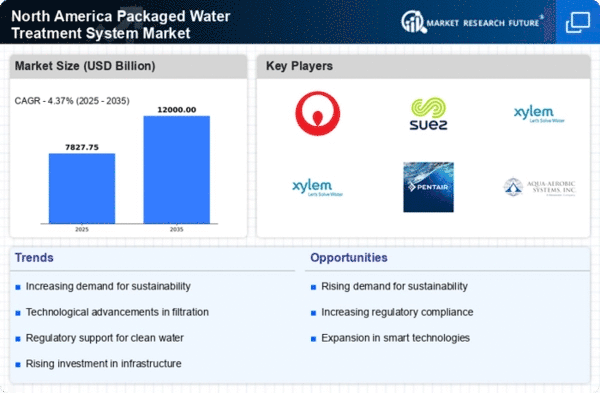

Market Analysis

In-depth Analysis of Americas Packaged Water Treatment System Market Industry Landscape

The industrial landscapes of Canada and the United States have exhibited a consistent growth pattern in recent years, and South American countries are following suit with ongoing developments in the manufacturing sector. This upward trajectory is expected to significantly drive the market for packaged water treatment systems. Notably, the mining industries in countries like Brazil and Chile have been witnessing steady growth since 2010, and the extensive use of packaged water treatment systems in these industries further amplifies their role in sustaining industrial development.

In Canada and the United States, the industrial sector has been a cornerstone of economic growth. The steady expansion of industrial activities has created a demand for efficient water treatment solutions, leading to an increased adoption of packaged water treatment systems. These systems offer a versatile and effective means of addressing water treatment needs in industrial settings, ensuring compliance with environmental regulations and sustainable water management practices.

South American countries, too, are experiencing significant developments in their manufacturing sectors, further contributing to the demand for packaged water treatment systems. The growth in industrial activities is particularly notable in Brazil and Chile, where economic dynamism has fueled expansions in various industrial segments. As these countries continue to advance economically, the need for reliable water treatment solutions becomes imperative, driving the adoption of packaged systems to meet the specific requirements of industrial applications.

One of the key industries propelling the demand for packaged water treatment systems in South America is the mining sector. Brazil and Chile, in particular, have seen substantial growth in their mining industries since 2010. Mining operations, by their very nature, require extensive water usage, and ensuring proper treatment of this water is essential for environmental conservation and compliance with regulatory standards. Packaged water treatment systems play a vital role in meeting the stringent water quality requirements imposed on the mining industry.

According to the Federal Reserve Bank, mining production in Chile witnessed a notable increase of 1.11% in 2013, while Brazil experienced a growth of 0.97% during the same period. These statistics underscore the pivotal role of the mining sector in the economic landscape of these countries and highlight the importance of water treatment solutions in sustaining and enhancing mining operations. Packaged water treatment systems offer a practical and efficient approach to addressing the unique water treatment challenges posed by mining activities.

The usage of packaged water treatment systems in the mining industry is multifaceted. These systems are employed to treat water used in various mining processes, such as extraction, processing, and transportation. By ensuring that the water meets stringent quality standards, packaged systems contribute to environmental conservation by minimizing the impact of mining activities on water resources. Additionally, the modular and portable nature of these systems allows for flexibility in deployment, catering to the dynamic and often remote locations of mining operations.

The growth of the packaged water treatment system market in South America is intricately tied to the broader industrial expansion in the region. As industries, particularly mining, continue to thrive, the demand for efficient water treatment solutions will persist. Packaged systems offer a comprehensive and adaptable solution, aligning with the diverse needs of industrial applications in South America.

The steady industrial growth in Canada and the United States, coupled with the burgeoning manufacturing sector in South American countries like Brazil and Chile, is propelling the demand for packaged water treatment systems. The pivotal role of these systems in the mining industries of Brazil and Chile underscores their importance in sustaining industrial development while adhering to environmental regulations. As the industrial landscape evolves, packaged water treatment systems are set to play an increasingly integral role in ensuring sustainable and responsible water management practices in the region.

Leave a Comment