Growth in Consumer Electronics

The proliferation of consumer electronics is significantly influencing the Americas, Europe & India Polypropylene Capacitor Film Market. With the rise of smart devices, including smartphones, tablets, and wearables, the need for reliable and efficient capacitors has surged. Polypropylene capacitors are favored for their stability and performance in high-frequency applications, making them ideal for modern electronic devices. The consumer electronics sector is expected to grow at a rate of 6% annually, which will likely enhance the demand for polypropylene capacitor films. This growth is indicative of a broader trend towards miniaturization and increased functionality in electronic products.

Rising Demand for Energy Efficiency

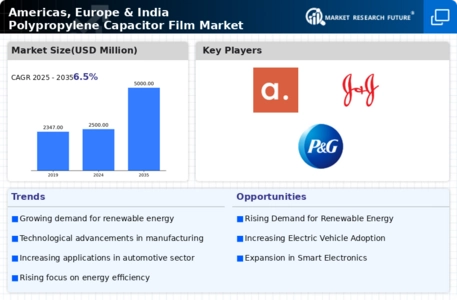

The increasing emphasis on energy efficiency across various sectors is driving the Americas, Europe & India Polypropylene Capacitor Film Market. As industries strive to reduce energy consumption and enhance performance, polypropylene capacitors are becoming essential components in energy-efficient devices. The market is projected to witness a compound annual growth rate (CAGR) of approximately 5% over the next five years, reflecting the growing adoption of these capacitors in renewable energy applications, such as solar inverters and wind turbines. This trend is further supported by government regulations promoting energy-efficient technologies, thereby bolstering the demand for polypropylene capacitor films.

Advancements in Manufacturing Technologies

Innovations in manufacturing technologies are reshaping the Americas, Europe & India Polypropylene Capacitor Film Market. Enhanced production techniques, such as advanced extrusion and film processing methods, are enabling manufacturers to produce high-quality polypropylene films with improved electrical properties. These advancements not only reduce production costs but also enhance the performance characteristics of the capacitors, making them more appealing to end-users. As manufacturers continue to invest in research and development, the market is likely to experience a surge in product offerings, catering to diverse applications across various industries.

Regulatory Support for Sustainable Materials

The increasing regulatory support for sustainable materials is influencing the Americas, Europe & India Polypropylene Capacitor Film Market. Governments are implementing stringent regulations aimed at reducing environmental impact, which is encouraging manufacturers to adopt eco-friendly materials in their products. Polypropylene, being recyclable and less harmful to the environment, aligns well with these sustainability goals. As a result, the market for polypropylene capacitor films is expected to expand, driven by both consumer preference for sustainable products and regulatory incentives promoting the use of environmentally friendly materials.

Increasing Adoption in Automotive Applications

The automotive sector's transition towards electrification is propelling the Americas, Europe & India Polypropylene Capacitor Film Market. With the rise of electric vehicles (EVs) and hybrid electric vehicles (HEVs), the demand for high-performance capacitors is on the rise. Polypropylene capacitors are utilized in various automotive applications, including power electronics and energy storage systems, due to their reliability and efficiency. The automotive industry is projected to grow at a rate of 7% annually, which may further drive the demand for polypropylene capacitor films as manufacturers seek to enhance vehicle performance and sustainability.