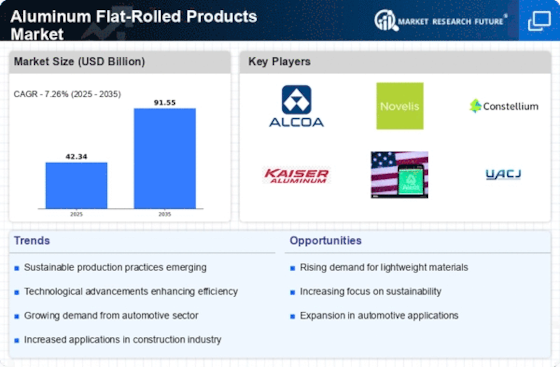

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Aluminum Flat-Rolled Products market, grow even more. Market players are adopting various strategies to extend their footprint, with important market developments including new product developments, contracts & agreements, mergers & acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Aluminum Flat-Rolled Products industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Aluminum Flat-Rolled Products industry to benefit clients and increase the market sector. In recent years, the Aluminum Flat-Rolled Products industry has offered some of the most significant advantages to medicine.

Major players in the Aluminum Flat-Rolled Products market, including Hindalco Industries Limited (India), Alcoa Corporation (US), Constellium (The Netherlands), Norsk Hydro ASA (Norway), Aluminum Corporation of China (Chalco) (China), Arconic (US), NALCO (India), UACJ Corporation (Japan), Elvalhalcor Hellenic Copper, Aluminum Industry S.A. (Greece), JW Aluminum (US), and others, are attempting to increase market demand by investing in research and development operations.

Aluminum is produced and exported by National Aluminum Co Ltd (NALCO). It conducts bauxite mining, alumina refining, Aluminum smelting and casting, power production, rail, and port operations. The company's main goods include chemicals and metals made of Aluminum. It runs bauxite mining in the Koraput district of Odisha's Panchpatmali Hills, an alumina refinery at Damanjodi, an Aluminum smelter, and a 1200 MW captive power plant in Angul.

Additionally, it runs four wind farms: a 50.4 MW wind farm in Gandikota, Andhra Pradesh; a 47.6 MW wind farm in Ludarva, Jaisalmer, Rajasthan; a 50 MW wind farm in Devikot, Jaisalmer, Rajasthan; and a 50.4 MW wind farm in Jath, Sangli, Maharastra.

In December The share price of National Aluminum Company increased by 5.77%.

The Department of Revenue, Ministry of Finance, Government of India stated in a notification dated December 6, 2021 that the dumping margin for the subject goods from the subject country is positive and important in the case of certain flat rolled Aluminum products originating in or exported from China. The ministry claims that the domestic industry has been materially harmed as a result of the dumping of Chinese goods.

Manufacturers and distributors of specialised rolled and extruded Aluminum products include Constellium SE (Constellium). Packaging, automotive rolled goods, aerospace, transportation, defence, end markets, automotive structures, and industrial items are all available. The business produces plates and sheets for the aerospace industry, as well as wing skins, general engineering plates, transportation sheets, packaging, and automotive rolled goods. Constellium also makes extruded items including automobile frames, huge profiles, and soft and hard alloys.

In January 2023, Constellium SE and Daher have a multi-year agreement under which the latter will receive a variety of flat-rolled Aluminum products from Constellium SE's factory in Issoire, France. In particular, the TBM and Kodiak versions of light aircraft will employ the Aluminum. Constellium can increase its customer base in the commercial and regional planes industry by joining Daher as a strategic Aluminum supplier.