Canada Aluminum Flat Rolled Products Market Summary

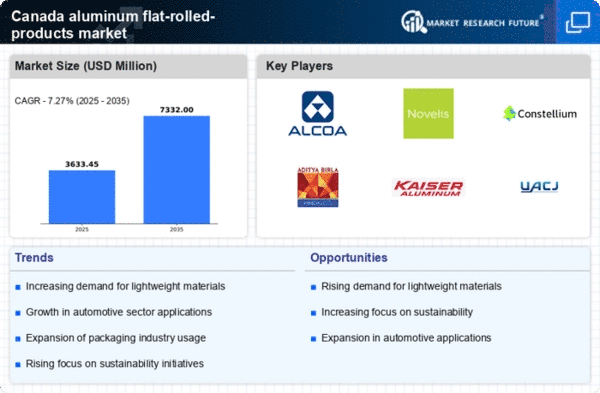

As per Market Research Future analysis, the Aluminum Flat-rolled-products market size was estimated at 3387.2 USD Million in 2024. The aluminum flat-rolled-products market is projected to grow from 3633.45 USD Million in 2025 to 7332.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 7.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Canada aluminum flat-rolled-products market is experiencing a robust growth trajectory driven by sustainability and technological advancements.

- The automotive sector represents the largest segment, reflecting a growing demand for lightweight materials.

- Packaging applications are the fastest-growing segment, driven by an increasing focus on sustainability and recyclability.

- Government support for infrastructure development initiatives is fostering market expansion across various applications.

- Rising demand in the automotive sector and technological innovations in manufacturing are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 3387.2 (USD Million) |

| 2035 Market Size | 7332.0 (USD Million) |

| CAGR (2025 - 2035) | 7.27% |

Major Players

Alcoa Corporation (US), Novelis Inc. (US), Constellium SE (FR), Hindalco Industries Limited (IN), Kaiser Aluminum Corporation (US), UACJ Corporation (JP), Aleris Corporation (US), Norsk Hydro ASA (NO)