Market Trends

Key Emerging Trends in the Alternative Fuel Vehicles Market

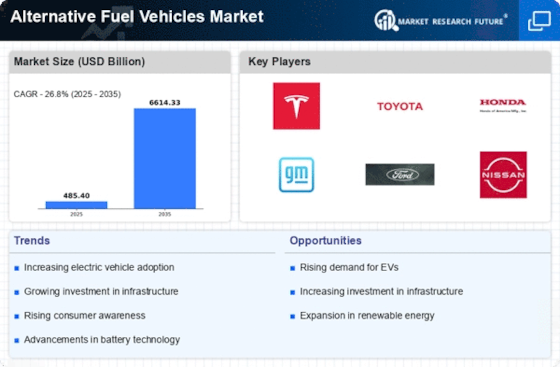

Due to advancements in battery technology, electric vehicles (EVs) are becoming more accessible to consumers, providing greater range and faster charging periods. States are also encouraging the use of EVs by providing endowments, tax advantages, and strict regulations on outflows, which is driving market expansion even further. Combination automobiles, which combine electric and traditional gas engines, continue to hold a significant portion of the market for alternative fuel cars. This dual power source reduces discharges and increases fuel productivity. Additionally, modular electric cars (PHEVs), which enable users to charge the battery using an external power source, are gaining some traction and provide a flexible solution for drivers who may have limited access to charging infrastructure. The increasing attention being paid to hydrogen fuel cell vehicles is another noteworthy trend. The only byproduct of using hydrogen gas to generate power in these vehicles is water vapor. Even though the development of hydrogen fuel cells is still in its early stages, certain automakers are investing in novel projects to overcome challenges including foundation enhancement and production costs. As the infrastructure for hydrogen recharging expands, fuel cell cars may become a viable option for consumers looking for a zero-emission substitute. To stay relevant in the ever-evolving business industry, laid-out brands are actively engaged in creative work. Meanwhile, new competitors—particularly startups that invest heavily in electric vehicles—are gaining ground and introducing creative ideas and technological innovations to a larger portion of the market. This competitive environment is fostering growth and bringing costs down, opening alternative fuel vehicles to a wider range of consumers. The market for alternative fuel cars is being affected by the concepts of roundabout economy and manageability. As a result, manufacturers are emphasizing eco-friendly materials, recyclable materials, and energy-efficient assembly techniques more than before. Coordination of sustainable practices puts organizations in a position to be noticed and aligned with the ideals of buyers. The future of alternative fuel cars is also being shaped by related and independent innovations. The automotive industry is expected to evolve toward more independence, and alternative fuel cars are expected to be at the forefront of this mechanical disruption. The rise of electric cars, along with advances in hybrid technology, research into hydrogen fuel cells, and a focus on maintainability, are reshaping the automotive industry.

Leave a Comment