Market Share

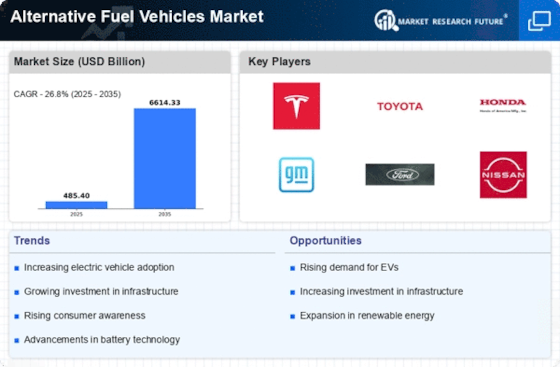

Alternative Fuel Vehicles Market Share Analysis

Enterprises are actively engaging in innovative efforts to improve the efficiency and implementation of alternative fuel innovations, such as biofuels, hydrogen, and electric vehicles. By providing cutting edge solutions, these companies hope to break through into a unique market niche and attract environmentally conscious consumers searching for the newest developments in affordable transportation. As demand for AFVs increases, manufacturers are working to lower the price of their products by taking advantage of economies of scale and technological developments. With alternative fuel vehicles accessible to a larger segment of the population, this strategy aims to increase the number of customers and gain market share. These cooperative efforts support the resolution of issues related to the infrastructure for charging, refueling, and administrative systems, fostering an environment favorable for the widespread adoption of AFVs. The impact of marking and advertising methods on piecing together a portion of the market is crucial, even in the face of innovation and cost. Businesses are increasingly highlighting the environmental benefits of AFVs and emphasizing their responsibility for manageability. Developing strong points of differentiation for a brand that resonates with environmentally conscious consumers can help a business stand out in a crowded market and capture a larger share of the growing demand for alternative fuel vehicles. Participating in endowment programs, adhering to outflows ideals, and skillfully influencing legislators to create a robust administrative atmosphere are a few examples of such actions. Organizations that align with government initiatives can gain a competitive edge and capitalize on the factors that encourage consumers to use AFVs. Additionally, businesses are focusing more and more on client education and mindfulness as part of their pie-positioning strategy. As advancements in alternative fuel technologies continue, prospective purchasers may not be familiar with the benefits and functional components of AFVs. Investing in educational initiatives that elucidate and simplify the innovation can help foster customer confidence and promote uptake. Organizations in the AFV sector should continuously adapt and improve their systems as the world shifts toward a more practical future to get a clear and strategic advantage in this rapidly growing business sector.

Leave a Comment